SAEDNEWS: American Express, also known as Amex, is a leading global provider of financial, insurance, and travel services, headquartered in New York.

According to SaedNews Success World Service, American Express is one of the largest financial services, insurance, and travel companies in the world, with a history spanning over a century and a half. American Express Company, also known as Amex, is an international company based in the United States, focusing on financial services, insurance, and travel. Its headquarters is located in the World Financial Center in New York. Currently, American Express is among the 30 companies listed on the Dow Jones Industrial Average.

American Express is best known among the public for its credit and charge cards, which in the United States are considered main competitors to Mastercard and Visa. According to 2016 statistics, American Express network cards accounted for 22.9% of financial transactions in the U.S. By 2017, the company had around 113 million cards in circulation, 50 million of which were in the United States.

Founding and Early History

The roots of American Express trace back to a postal company founded by Henry Wells in New York in 1841. Wells began his career working for William Harnden, the founder of the first U.S. postal company. At that time, postal companies were responsible for transporting money and other valuable assets. Wells intended to expand Harnden’s business from the eastern U.S. to central and western regions, but Harnden opposed the idea. Ultimately, Wells established his own company, Well & Co, in 1841. American Express was formed later through the merger of three major postal competitors in the United States.

Initially, the company served only New York and Buffalo. A few years later, Wells’ acquaintance with William J. Fargo enabled expansion into central U.S. regions. Despite customer satisfaction, profitability was limited for the founders, leading Wells to focus primarily on New York, Buffalo, Boston, and Albany while transferring western Buffalo operations to Fargo’s Livingston company.

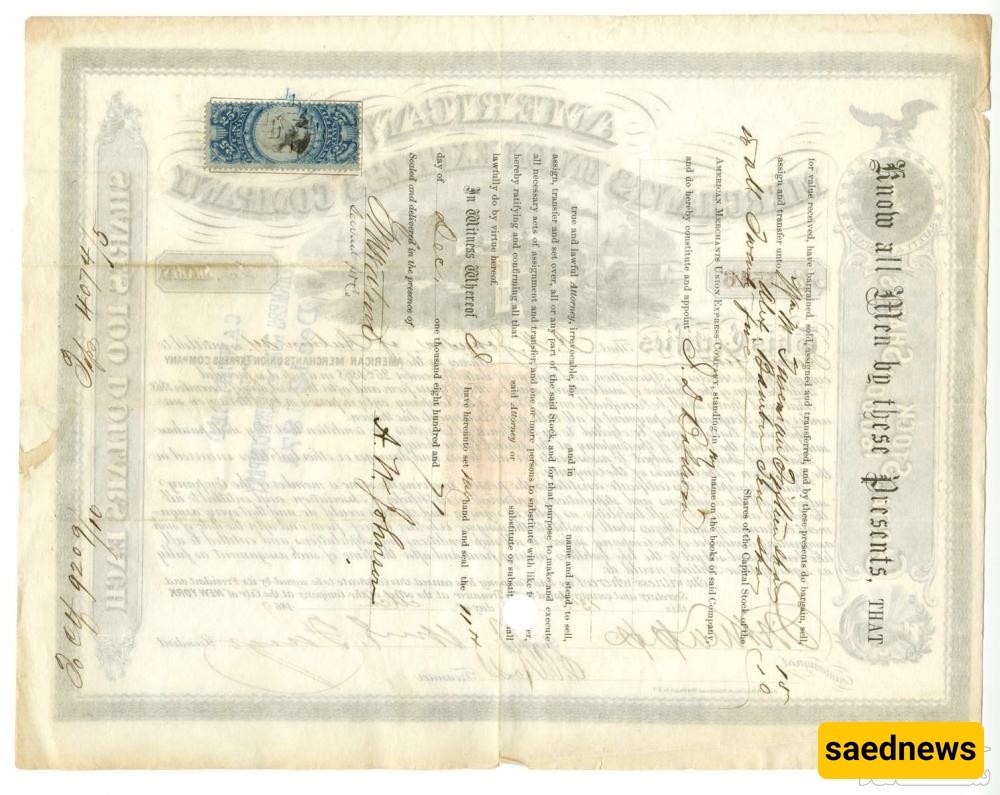

In 1849, transportation industry leader John Butterfield entered the postal business, creating a significant rivalry with Wells in New York under Butterfield, Wasson & Co. After several years, Butterfield proposed a partnership, resulting in the merger of the three companies and the formal establishment of American Express on March 18, 1850, with an initial capital of $150,000. Wells served as the first president, and Fargo as vice president.

Under Wells’ management, American Express achieved significant profitability. Beyond acquiring smaller competitors and expanding land-based markets, the company also extended water transportation to regions such as Illinois and Iowa through the Illinois waterways. A key agreement in 1851 with Adam Express allowed American Express to cover northern and western New York, while Adam Express served the south and east. This agreement lasted seventy years, providing American Express with ample growth opportunities.

Despite the agreement, Wells and Fargo were concerned about Adam Express dominating the California gold market. They also proposed expanding internationally, which the board opposed. In 1852, they founded Wells Fargo, which operated independently in California’s banking and postal markets.

Expansion During the Civil War

Significant developments during the 1850s included the creation of the International Postal Service, Overland Mail, in 1857, in collaboration with Wells Fargo, Adam Express, and United States Express. The Merchant Dispatch company was established the following year at the suggestion of James Fargo, William’s younger brother.

The U.S. Civil War marked a turning point for American Express and the postal system. The company transported essential supplies for the military and also handled election ballots. These activities generated substantial profits for shareholders. By 1862, the company operated 890 offices with over 1,500 employees, connecting the eastern U.S. to Minnesota and Missouri via approximately 10,000 miles of rail and road lines.

Entry Into Financial Services

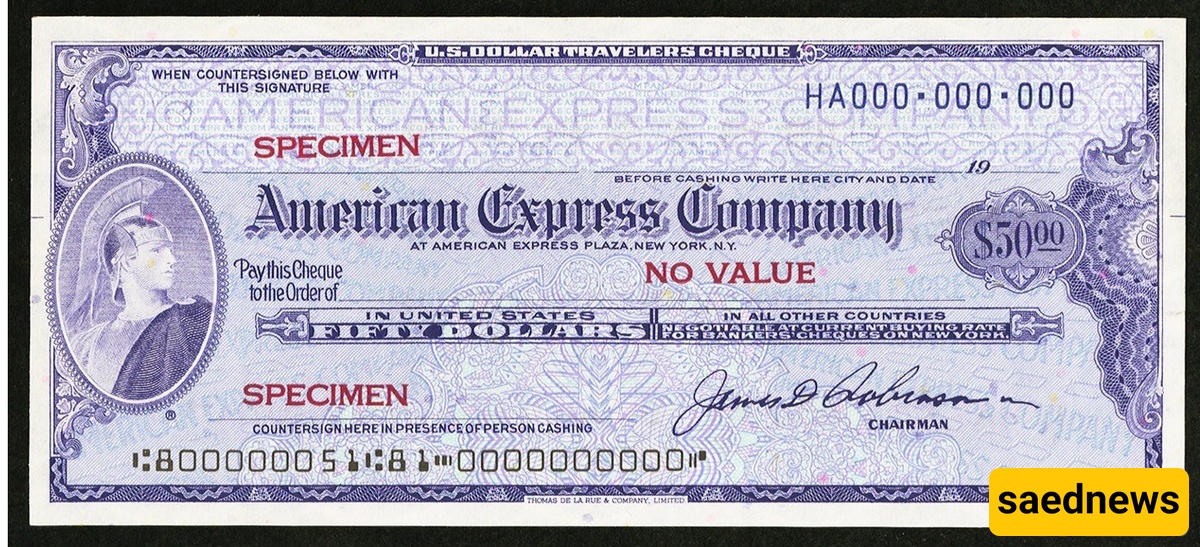

Following the war, American Express leveraged its reputation to enter financial markets. Under James Fargo, the company introduced innovations such as American Express traveler's checks. These financial instruments provided secure and convenient money transfer solutions for travelers, particularly immigrants sending funds to their home countries. They also gradually replaced government-issued money orders for everyday household bills.

Marcellus Berry, an American Express employee, designed these financial processes. The traveler's checks facilitated currency exchange and insured funds, representing a major success for the company’s financial sector and bridging the travel and financial industries.

Credit Cards and Modern Expansion

In the mid-1950s, the Diners Club introduced the world’s first credit card, inspiring American Express to explore this emerging market. In 1958, American Express launched its first credit card, which quickly gained traction, reaching 500,000 users within three months. The introduction of the green credit card increased annual revenue from $8.4 million in 1959 to $85 million in 1970.

Under subsequent leadership, American Express expanded its travel and financial services, diversified globally, and modernized its organizational structure. By the 1990s, the company faced challenges from competitors like Visa and Mastercard, leading to strategic adjustments, including lowering merchant fees.

With the rise of the internet, American Express launched its ExpressNet website in 1995, providing online services to cardholders and travelers. The company introduced Blue, the first smart credit card in the U.S., using microchip technology instead of magnetic stripes, paving the way for e-commerce.

Global Presence Today

Currently, American Express offers a wide range of financial and travel services and operates numerous offices worldwide. Headquarters are in New York’s World Trade Center, with additional major offices in Florida, Arizona, Canada, the U.K., Singapore, Australia, and India. Key shareholders include Berkshire Hathaway, Vanguard Group, BlackRock, and State Street Corporation. Stephen J. Squeri serves as CEO and chairman. In 2017, American Express reported revenues of $33.47 billion and approximately 55,000 employees. Forbes ranks American Express as the 28th most valuable global brand, following its long-time competitor, Visa.