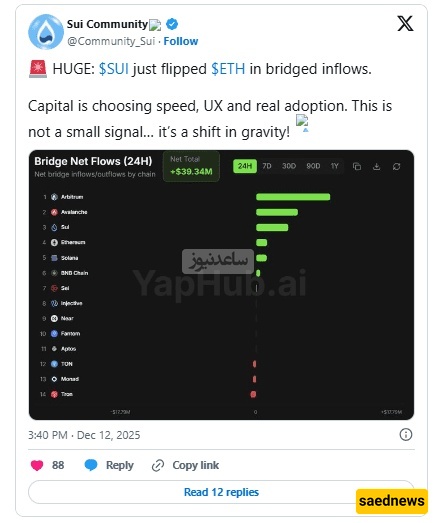

SAEDNEWS: In a notable shift in the cryptocurrency market, the Sui network has overtaken Ethereum in daily capital inflows. This development has drawn analysts’ attention to changing liquidity flows, the rise of emerging projects, and a shift in investor focus from traditional blockchains to next-generation platforms.

According to Saed News’ cryptocurrency service, citing Digikato, on-chain data recorded this week shows Solana leading Ethereum in daily capital inflows via blockchain bridges. After Arbitrum and Avalanche, Solana claimed the third spot.

Tacknock’s crypto service reports that this trend reflects growing attention from users and investors toward the network. Solana is currently trading around $1.57, with on-chain data fueling optimism for a potential price rebound to $2.10.

Although Ethereum remains the leader in total value locked (TVL), Solana is seeing significant growth in real network usage. Daily trading volume on decentralized exchanges within the network has reached $227 million, indicating active on-chain demand rather than short-term speculation. Market analysts interpret this trend as evidence that users increasingly prioritize faster speeds, lower fees, and smoother user experiences over traditional positions.

Solana’s growth is closely linked to its object-oriented design, which enables the network to process large volumes of transactions simultaneously. This architecture keeps the network fast and low-cost even during periods of high congestion.

Kyle Chase, a cryptocurrency investor, explained that this design performs exceptionally well in real-world conditions, reducing network congestion, lowering fees, and minimizing latency. These factors make Solana appealing to decentralized applications, traders, and developers alike.

Simplified development processes attract more creators to the network. As the number of applications and users grows, liquidity flows in and tends to stay, supporting Solana’s gradual and sustainable growth.

Despite positive capital inflow data, Solana’s price has dropped about 5% today, trading around $1.57. Its market cap stands at approximately $5.9 billion, with daily trading volume at $706 million, indicating sustained high activity.

Analysts note that Solana’s one-hour chart shows signs of a potential weekly-scale price reversal. If the price recovers after a minor dip, it could rise toward $1.78.

Strong support in the $1.70–$1.80 range may signal a trend change and pave the way for a move toward $2.10. Conversely, a drop below $1.51 could lead to a fall to $1.38. Nevertheless, robust capital inflows suggest continued strong interest in Solana.