Confused about whether your workshop tools or tractor are taxable under khums? Here’s what the country’s top clerics rule — and the surprising exceptions that could save your livelihood.

Conditions for khums on work tools, machinery, and tractors according to the fatawa of the sources of emulation. Examination of items such as price appreciation and personal versus commercial use.

The rulings on khums regarding work tools and machinery are detailed because these items are considered part of mu'ūna (costs of living and of conducting a business). Therefore, they must be handled according to the fatwa of each person’s own marja‘ (source of emulation). Below we discuss the topic generally and with reference to the opinions of the senior maraji‘ (sources of emulation):

For income generation (business capital): If the work tools or machinery were acquired for the purpose of earning income — as primary or secondary capital for the business — they are generally subject to khums. In other words, if these tools and machines are used to generate profit and to secure livelihood through business activity, their principal (purchase price) and, in some cases, any price increase realized upon sale are liable to khums.

For personal use (mu'ūna of life): If machinery or tools (such as a private car, household tools, or even a simple tool used for personal, non-commercial tasks) are acquired to meet personal needs and are in keeping with the individual’s social standing, and they were purchased from that year’s income, then khums does not apply to them.

From the same year’s income: If the work tools or machinery were bought from the khums-year’s (khamis) income and were needed by the end of that khums-year and used in the business, then — according to some of the maraji‘ — they are not liable to khums. However, if they were purchased with surplus income from previous years for which khums has not been paid, then khums must be paid on them.

From already-khums-paid money (māl-e makhmas): If the tools or machinery were bought from funds on which khums has already been paid (māl-e makhmas), the principal itself is not subject to khums. But any profit or increase in value produced by using that capital, if not spent on mu'ūna by the end of the khums-year, may be subject to khums.

Purchased on credit: If the tools or machinery were bought on debt (on credit) and the payment is made from income of later years, some of the maraji‘ consider the purchase price at the time of acquisition to be the reference point.

The Supreme Leader (Ayatollah Khamenei): In general, capital, tools, machines, and work equipment whose income is used for ordinary livelihood are subject to khums, except in cases where paying khums would make it impossible to continue working and to provide for ordinary livelihood.

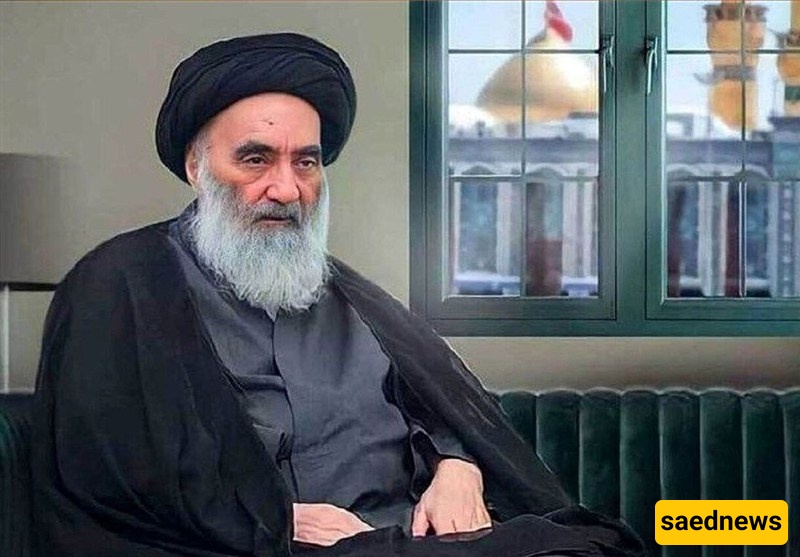

Ayatollah Sistani: If tools and work equipment are purchased from earned income and are needed for the continuation of the business, they are subject to khums. However, if paying khums would prevent the person from maintaining his customary standard of living, then khums is not obligatory.

Ayatollah Makarem Shirazi: Work tools and machinery, insofar as they are considered business capital, are subject to khums.