Zakat is one of the obligatory financial duties in Islam, according to which Muslims must pay a specified amount of Zakat from nine types of goods to which Zakat applies. Stay with Saadnews for more on this topic.

Zakat is one of the obligatory financial duties in Islam, according to which Muslims must pay a specified amount from 9 categories of goods for the benefit of the poor and other public social needs. These 9 items are: currency (gold and silver), livestock (cattle, sheep, and camels), and four types of grains (wheat, barley, raisins, and dates). The amount paid for each of these items differs and is specified in Islamic jurisprudence.

Zakat is one of the most important religious obligations, and great emphasis is placed on it. Zakat is considered one of the branches of the religion and is mentioned alongside prayer and jihad in religious texts, being one of the five pillars of Islam. Zakat is referenced in 59 verses of the Quran and around 2,000 Hadiths. In many cases, the Quran uses the term "charity" to refer to Zakat, and in Islamic jurisprudence, Zakat is often called "obligatory charity."

There are two types of Zakat:

Zakat al-Fitr (the charity given during Eid al-Fitr)

Zakat al-Mal (the charity given on the four grains, livestock, and coins with specific conditions).

Wheat

Barley

Dates

Raisins

Gold

Silver

Camels

Cattle

Sheep

Trade goods, by precautionary necessity

Amount of Zakat for Grains:

The Zakat for grains, if irrigated by rainwater, streams, or similar natural sources, is one-tenth of the harvest. If irrigated by artificial means, such as a bucket, rope, camel, wheel, machinery, or similar, it is one-twentieth. If both methods are used, the larger method takes precedence. In cases where both methods are equal, the Zakat is one-tenth of half the harvest and one-twentieth of the other half.

Conditions for Zakat on Grains:

For Zakat on grains (wheat, barley, dates, and raisins), two conditions must be met:

The ownership of the harvest

Reaching the threshold amount (207 Mān, which is equivalent to 847 or 885 kilograms).

The amount of Zakat for grains ranges from one-tenth to one-twentieth of the harvest, depending on the irrigation method.

Amount of Zakat for Gold and Silver:

Zakat on gold and silver becomes obligatory when they are minted into coins, and the trade of those coins is common. If the coins are destroyed, Zakat must still be paid.

Gold has two thresholds (Nisab):

The first Nisab is 20 mithqāl, which is equivalent to 18 grains, and when gold reaches this amount, the person must pay 1/40 (2.5%) of it, equivalent to 9 grains.

The second Nisab is 4 mithqāl, and when the amount of gold reaches 18 mithqāl, the Zakat is calculated on the whole 18 mithqāl. If the amount is less than 18, no Zakat is due.

For silver, there are also two thresholds:

The first Nisab is 200 dirhams, equivalent to 105 mithqāl. When silver reaches this amount, the person must pay 1/40 of it.

The second Nisab is 40 dirhams, equivalent to 21 mithqāl, and if it reaches 126 mithqāl, Zakat is due on the entire amount.

Conditions for Zakat on Livestock:

For Zakat on livestock (camels, cattle, and sheep), four conditions must be met:

A full year has passed.

Grazing in the wild (not on hay).

The animals are not used for work throughout the year.

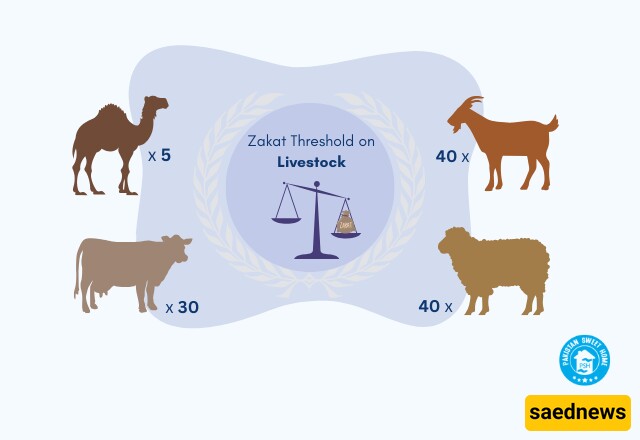

Reaching the Nisab threshold:

The Nisab for camels is 5 animals, and the Zakat is 1 sheep.

The Nisab for cattle is 30 animals, and the Zakat is 1 two-year-old calf.

The Nisab for sheep is 40 animals, and the Zakat is 1 sheep.

Zakat al-Fitr:

Zakat al-Fitr is obligatory after the month of Ramadan and with the arrival of Eid al-Fitr. The amount is 1 ṣāʿ (approximately 3 kilograms) of wheat, barley, dates, or raisins for each person, and every individual who is obliged must pay this for themselves and those they are responsible for. Instead of food, the equivalent value can also be given to the poor.

Can Taxes Replace Zakat?

There are various opinions on whether taxes can replace Zakat, especially given the distinction between Zakat and taxation in some modern discussions. Some consider taxes as a substitute for Zakat, while others, citing the Quran and Hadiths, distinguish between the two, arguing that Zakat is an independent obligation with specific requirements and uses.

Why is Zakat Obligatory?

The obligation of Zakat is one of the fundamentals of Islam and is agreed upon by all Muslims. Denying its obligation leads to apostasy. Zakat is considered an act of worship, and thus, a sincere intention (niyyah) is required when paying it. Several verses in the Quran, such as 7:156, 27:3, and 41:7 (all from the Makki surahs), indicate that the obligation of Zakat was revealed in Makkah. Muslims were commanded to observe this obligation, and after the migration to Madinah, Prophet Muhammad (PBUH) was entrusted with the task of collecting Zakat from the people.