SAEDNEWS: In this post we look into the impact of digital currency on the iranian market.

According to SAEDNEWS, amidst the hurdles posed by international sanctions, Iran is looking to digital money as a way to bolster its economy. With the global explosion of cryptocurrencies, Iran's government has made considerable moves toward building its own national digital currency to circumvent the limits of existing banking institutions. Iran's interest in digital currency stems from a desire to remove financial obstacles, maintain economic stability, and provide Iranians with a modern alternative to banking services. This blog will look at how bitcoin is becoming an important part of Iran's financial policy, as well as the possible advantages of adopting this new technology in a sanctioned economy.

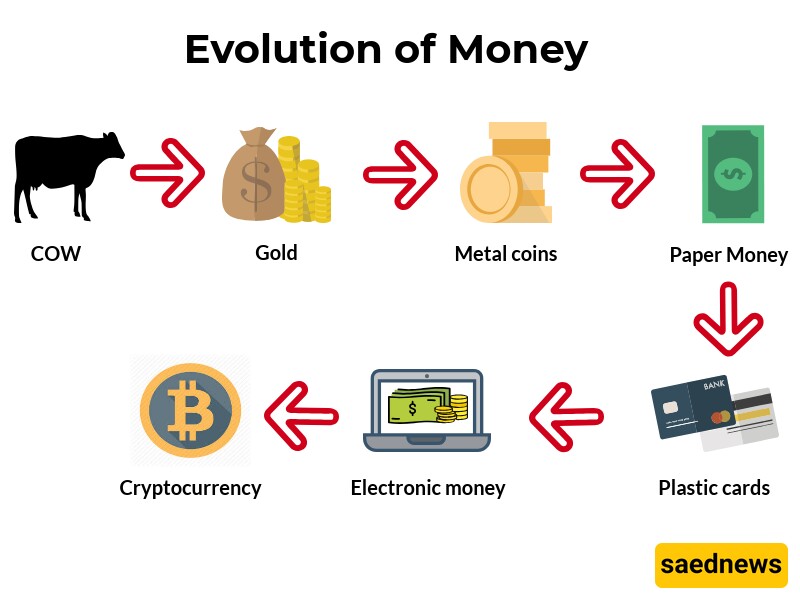

In recent years, cryptocurrencies such as Bitcoin and Ethereum have grown in popularity throughout the world, offering individuals an alternative to established banking systems. Iran sees the development of a national digital currency as a proactive strategy to addressing the hurdles created by sanctions and limited access to international payment networks. The new digital currency is intended to speed financial transactions, increase transparency, and enable more effective monetary policy. One of the primary advantages of a national digital currency is its ability to facilitate the movement of money across borders. International sanctions have separated Iran from the global financial system, making it harder for the government to conduct transactions with other countries. Iran might expand its foreign trade routes by using digital money, lessening its dependency on third-party financial institutions.

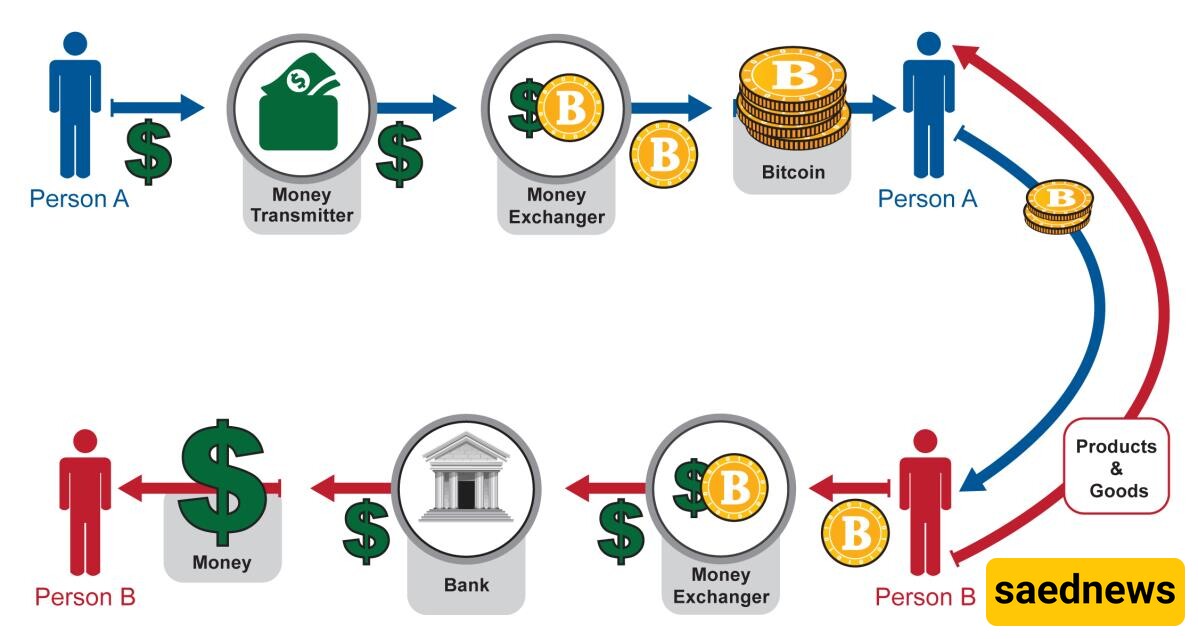

Iran's official digital money, established by the Central Bank of Iran, runs on a blockchain technology. Blockchain technology enables safe and transparent transactions, making it perfect for countries seeking to sidestep existing banking systems. Digital currency may be used for a variety of financial objectives, including purchasing products and services, transferring funds, and even undertaking international transactions. The government has already begun a trial phase for the digital money in a variety of sectors, with significant demand from local firms and industries. This novel technique tries to mitigate the effects of financial penalties while keeping the country's economic activity steady and efficient.

E-commerce is one of the most potential areas of digital currency adoption in Iran. Iran's expanding e-commerce sector has experienced hurdles due to limited access to global payment systems such as PayPal and Visa. The advent of Bitcoin opens up new opportunities for Iranian enterprises to engage in international trade by enabling cross-border transactions without the need for intermediaries. Iran's acceptance of digital currency may potentially boost commerce with nations like China and Russia, which already use or accept bitcoin as a payment mechanism. Iran might join into the global digital economy and create new export and import opportunities by developing a digital currency that adheres to global cryptocurrency norms.

Cryptocurrency provides a way to avoid many of the economic limits imposed by international sanctions. These sanctions have had a substantial impact on Iran's traditional banking sector, reducing its capacity to conduct foreign commerce and access global financial markets. Iran may efficiently decentralize financial transactions by adopting a digital currency, decreasing its reliance on existing banking institutions while maintaining transaction security, speed, and efficiency. Furthermore, the digital currency gives Iran's central bank more direct influence over its monetary policy, as it can monitor money flow in real time. This degree of regulation may be essential for combating inflation and bringing stability to the Iranian economy.

While the adoption of digital money in Iran presents great opportunities, considerable hurdles remain. For starters, the global cryptocurrency market is extremely volatile, and swings in digital asset values might have an influence on Iran's economy. Additionally, broad use of cryptocurrencies in Iran would necessitate considerable infrastructural enhancements, such as digital wallets and cryptocurrency exchanges. Nonetheless, the potential advantages of digital currency cannot be overlooked. Iran's continued investment in this field will almost certainly meet opposition from established financial institutions, but the long-term prospects for the country's financial independence remain encouraging.

The adoption of a national digital currency by Iran is an important step in adjusting to the shifting global financial environment. Iran may avoid financial sanctions by embracing blockchain technology, which will increase e-commerce and enhance financial transparency. While problems exist, digital currency's potential to transform Iran's economic future is obvious. The nation's adoption of cryptocurrencies shows a proactive attitude to economic stability and success, even in the face of hardship, as it continues to innovate and adjust to changes in the global economy.