SAEDNEWS: Asia-Pacific remains the beating heart of anime. Japan, China, and South Korea are the region’s top producers and consumers, making it natural that the largest share of the market continues to reside here.”

From the very first scene, anime draws viewers into vibrant worlds filled with colorful characters and unique stories. Though the average Japanese person may have small eyes, the iconic large-eyed anime characters have captured the hearts of audiences worldwide, becoming a global cultural phenomenon. In recent years, the global anime industry has experienced unprecedented growth.

In 2024, the global anime market was valued at approximately $34.26 billion—equivalent to nearly 2,398 trillion Iranian tomans at a rate of 70,000 tomans per dollar. To put this in perspective, Iran’s top-grossing animation, Babaei Hero, made only 67.9 billion tomans. To match the global anime market, this film would need to be screened over 35,000 times—a testament to the sheer scale and influence of the anime industry.

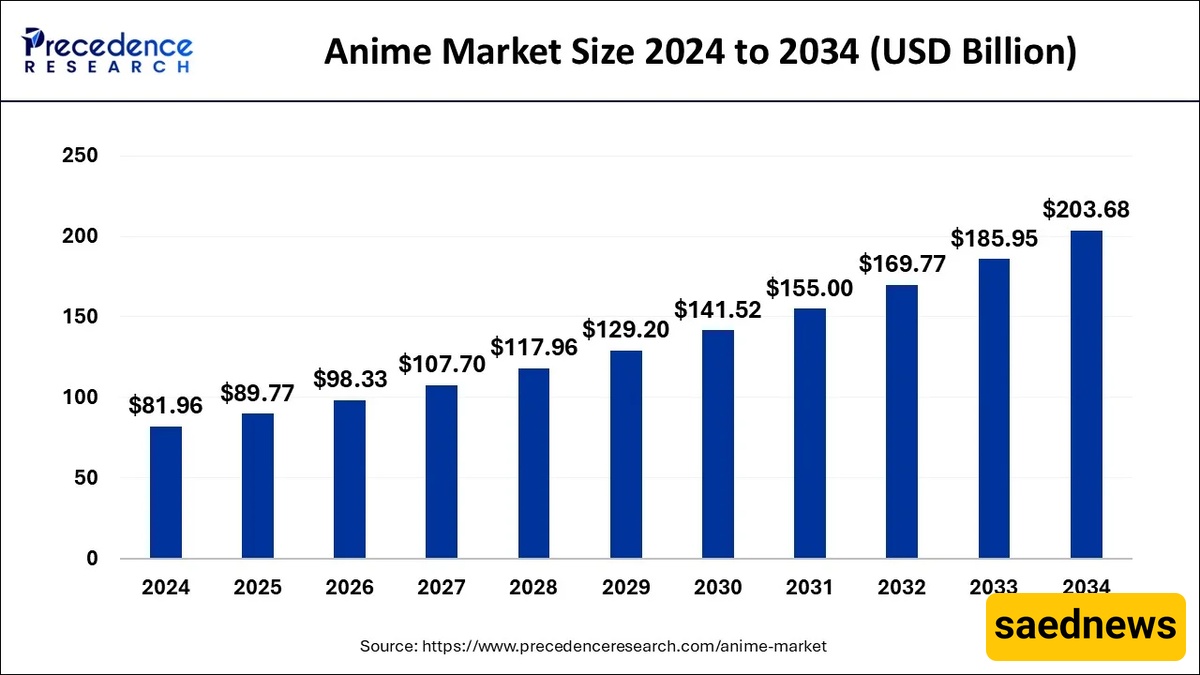

Predictions suggest the anime industry could reach $60.27 billion by 2030, growing at a compound annual growth rate (CAGR) of 9.8% between 2025 and 2030. This growth is largely driven by the expansion of social media, which allows fan communities to thrive and interact more actively. This report explores the global anime market, its genres, products, regional popularity, and key industry developments.

Anime is no longer just a Japanese cultural product—it has become a global industry, growing bigger and more lucrative each year. In 2018, the global market was around $20 billion. By 2024, it surpassed $34 billion, and it is expected to reach $60 billion by 2030—nearly tripling in just 12 years. Yet this growth hasn’t been uniform worldwide; each region tells a different story.

Asia-Pacific remains the heart of anime, with Japan, China, and South Korea as its largest producers and consumers. However, Asia’s relative share is slowly declining as other regions catch up. Europe, long familiar with anime, has recently expanded its audience through streaming platforms and high-quality dubbing. France, Germany, and Spain boast vibrant markets, with cinemas often filled for major anime releases. While Europe may not dominate the market, its growth is steady and reliable.

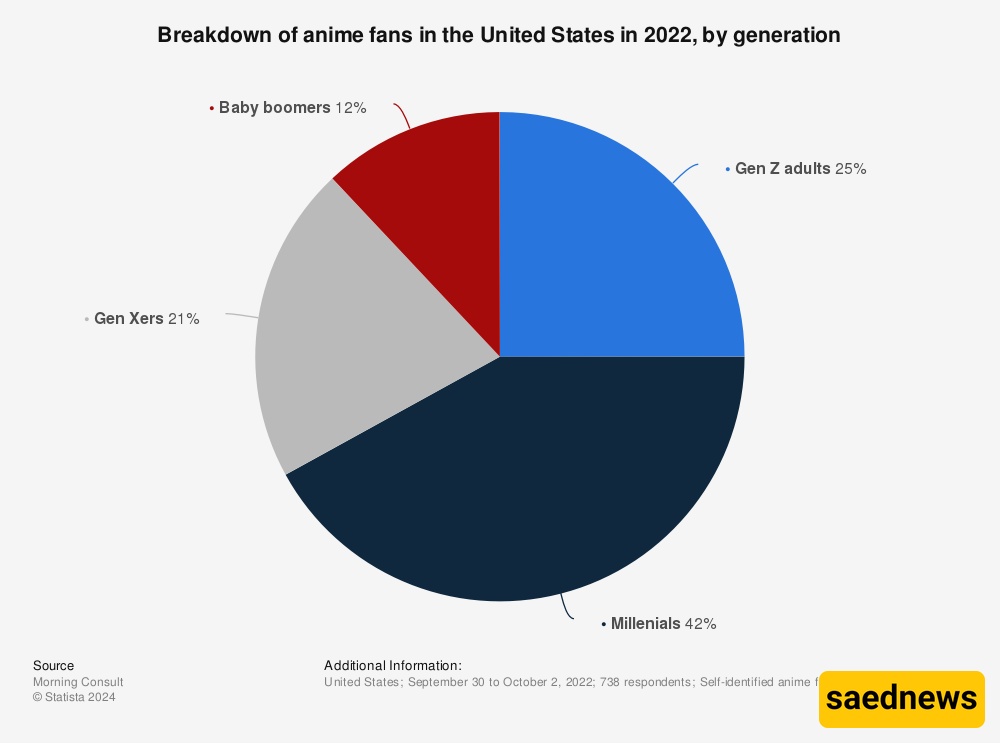

North America presents a different story. Once a small player, it is now one of the fastest-growing markets. Anime has entered mainstream pop culture in the U.S., bolstered by collaborations with Hollywood studios and professional dubbing, making it a central part of the entertainment landscape. Latin America also has passionate fans, especially among teenagers and young adults in Mexico, Brazil, and Argentina, with social media brimming with energetic anime communities. The Middle East and Africa, previously minor markets, are now emerging thanks to improved internet access and translations in Arabic and Persian.

In short, anime has transformed from a local Japanese entertainment form into a global phenomenon. Asia still leads the market, but the rapid growth in North America, the Middle East, and other regions signals a diverse and truly international future.

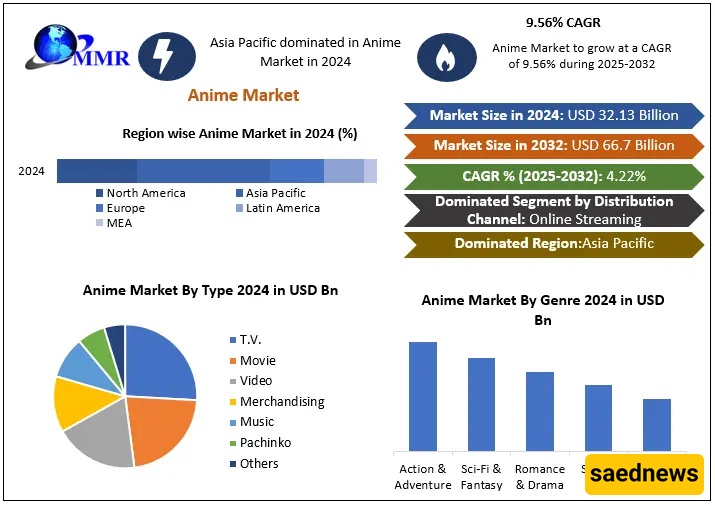

In 2024, the global anime market was valued at $34.26 billion, with Asia-Pacific holding about 27% of the share. Japan alone controlled over 39%, thanks to rising global sales. China is a key driver of market expansion, fueled by increasing income and demand for diverse entertainment. By 2025, the market is projected to reach $37.7 billion, with a CAGR of 9.8% to $60.27 billion by 2030.

North America is expected to grow at 16.3% annually between 2025 and 2030, benefiting from easy streaming access and advanced technology. Europe will grow steadily at 11.2%, with young fans driving demand and streaming platforms supporting access to new content. Japan remains the beating heart of anime, with its rich cultural legacy, loyal fans, and continuous innovation keeping it at the center of global expansion.

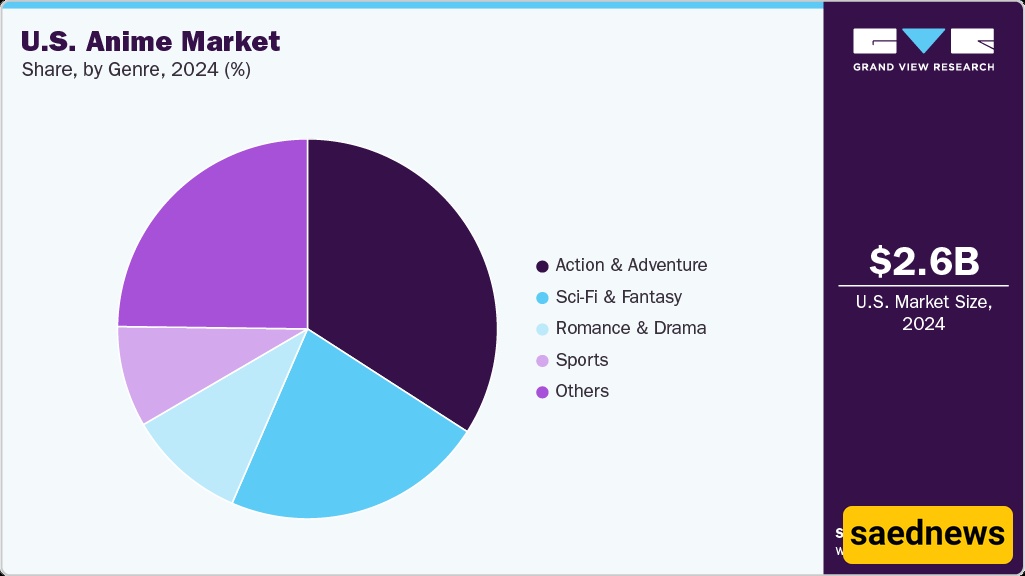

Streaming platforms have revolutionized access, breaking geographical boundaries and bringing anime to global audiences. Advanced animation software, VR, and AR technologies provide immersive experiences, while international collaborations elevate content quality and expand reach. The convergence of anime and video games also draws new audiences, including gamers previously unfamiliar with the medium. Merchandising, from figures to apparel, now accounts for 31.6% of total industry revenue, highlighting the economic power of anime beyond the screen.

Despite global success, Japanese studios face financial and structural challenges. In 2024, the domestic anime production market was valued at $2.45 billion, a 4% increase from the previous year. Yet only 37% of studios increased revenue, while 21% saw declines, and 42% remained flat. Profitability is also uneven: around 60% of studios earned less or operated at a loss due to a shortage of skilled animators, rising production costs, and heavy workloads. Consequently, production numbers have declined, with just 300 new series in 2023, the lowest in a decade.

In other words, while the global anime market thrives, the heart of the industry in Japan faces challenges that, if unaddressed, could threaten its future.