SAEDNEWS: Tensions in the Persian Gulf escalated dramatically as nearly 50 oil tankers began urgent maneuvers to exit the Strait of Hormuz, amid fears of its imminent closure following U.S. strikes on Iranian nuclear sites. Global energy markets brace for fallout as Tehran signals retaliatory action.

According to Saed News, A flurry of maritime activity in the Strait of Hormuz has triggered alarm across global energy markets, as over 50 oil tankers are reported to be rapidly departing the waterway in anticipation of a possible closure by Iran. The moves come amid heightened geopolitical tensions following U.S. airstrikes on three of Iran’s key nuclear facilities in Fordow, Natanz, and Isfahan.

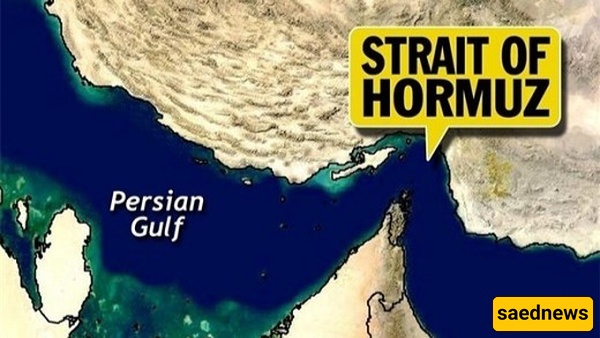

According to Saed News, citing shipping maps and sources from Fars News Agency, maritime traffic through the vital strait—through which over 20% of the world's oil supply transits—has intensified as operators seek to preemptively exit the region. The anxiety reflects growing fears that Tehran, in retaliation for what it describes as “aggression supported by the U.S. and Israel,” may shut the waterway entirely.

The panic has already begun rippling across global oil markets. Analysts warn that even the threat of a Hormuz closure could spike crude prices to levels unseen since the 2008 financial crisis. The CEO of Shell—one of the world's oil supermajors—recently warned of the “broad and seismic consequences” of any disruption to traffic through the Strait, highlighting surging insurance costs, logistical detours, and anticipated price shocks.

"Shipping premiums have already surged 150%," the executive noted. "We are entering uncharted waters."

According to the report, several tanker operators have started diverting shipments through longer, less efficient maritime routes to avoid entrapment in what could become a flashpoint of global conflict.

Fueling further uncertainty, Iranian Rear Admiral Alireza Tangsiri, commander of the IRGC Navy, declared that "the closure of the Strait of Hormuz is imminent." The announcement, though not yet officially confirmed as policy, is being read by observers as a serious strategic threat in direct response to what Tehran calls illegal and escalatory U.S. military actions.

The strategic calculus behind such a move is clear: while closing the strait would inflict economic damage on global markets, it would also send a powerful signal of Iran’s capacity to respond asymmetrically—by hitting the West where it hurts most: energy security.

The Strait of Hormuz has long been viewed as a geopolitical pressure valve, with past crises—from the Iran-Iraq War to U.S.-Iran naval standoffs—testing the limits of global maritime norms. However, the current situation, marked by a direct military confrontation involving nuclear installations and unprecedented retaliatory threats, may well represent the most volatile standoff in decades.

For now, oil majors and insurers are recalibrating risk models. Diplomats are scrambling behind closed doors. And the world watches as the Gulf’s narrowest passage becomes the focal point of a global showdown