Pope Leo XIV rolled out a moral mic drop this week, blasting Elon Musk’s eye-watering proposed $1 trillion pay package as a neon billboard for inequality — and Musk answered the market by plunking down $1 billion of his own cash into Tesla, sending the stock up and giving investors something to applause!

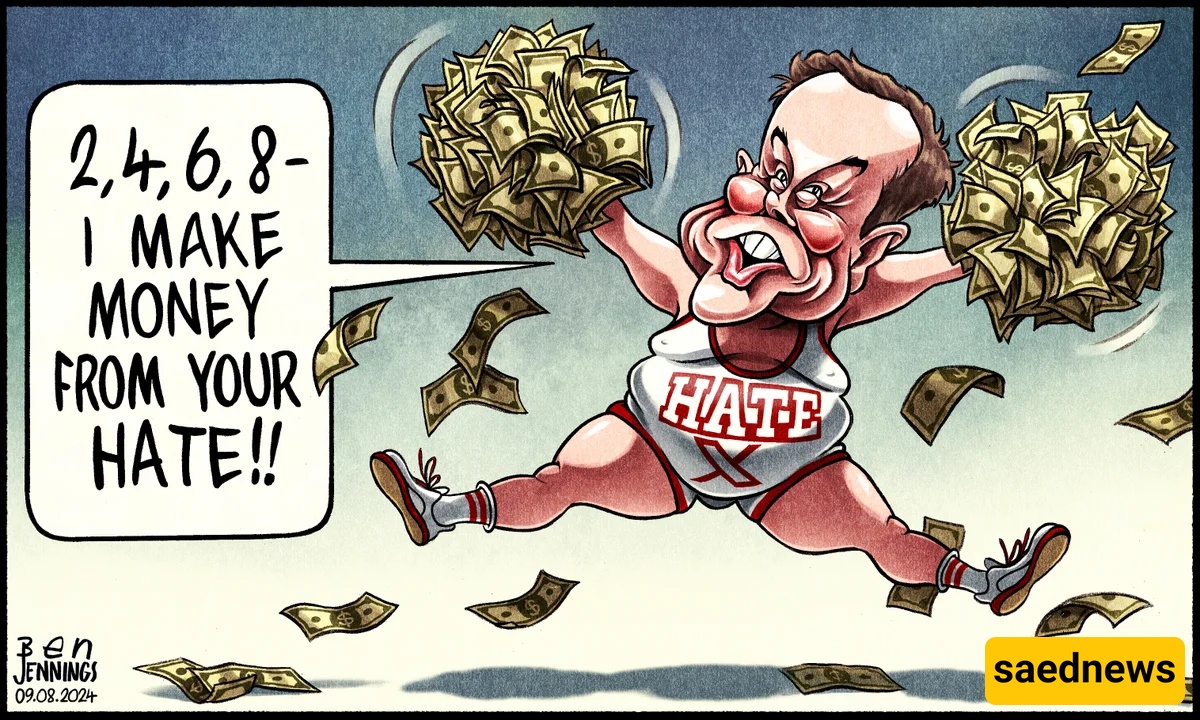

According to the provided text, Pope Leo XIV — described as the first American pontiff in the piece — criticized Elon Musk’s $1 trillion compensation proposal as an extreme example of wealth disparity. The Pope argued the plan highlights a worrying trend where astronomical CEO pay undermines social cohesion and places monetary gain above human values, urging societies to rethink their priorities.

Per the filing in your text, Musk personally purchased $1 billion in Tesla shares on Sept. 15, 2025. Investors read the move as a vote of confidence: Tesla stock jumped about 7% at the open, and the purchase reportedly added roughly $8.6 billion to Musk’s net worth — more than the cost of the share buy.

The controversial compensation package would be heavily performance-contingent: Musk wouldn’t see extra shares or pay unless Tesla hits steep valuation and sales benchmarks. For the full payout (and the title of first trillionaire), Tesla would need to soar to an $8.5 trillion market cap over the next decade — a level that would dwarf today’s top companies.

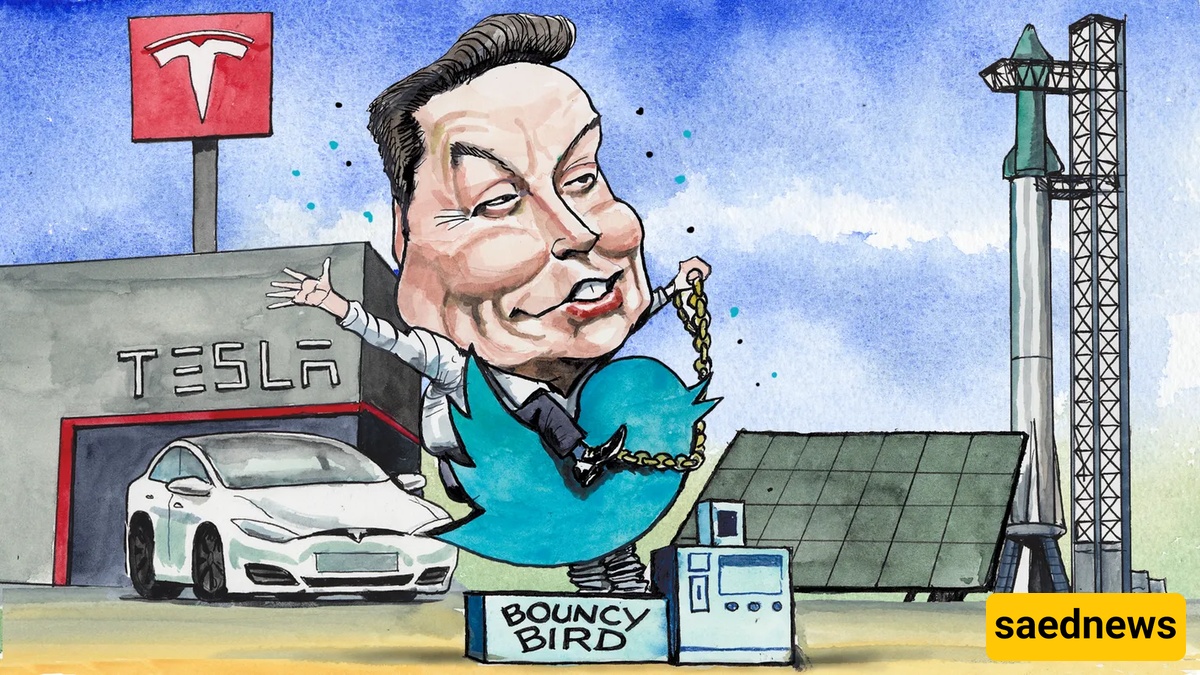

Tesla’s board, led by chair Robyn Denholm, defends the proposal as a retention and incentive tool — they say Musk’s rare mix of talents justifies a plan that’s contingent on massive future performance. The package is painted as a mechanism to keep Musk focused on Tesla despite other commitments like SpaceX, xAI and X.

Tesla’s year hasn’t been smooth: the stock has been volatile amid Musk’s political ties and shifting public image, competition — especially from Chinese EV maker BYD — is growing, and the expiry of a $7,500 U.S. EV tax credit threatens near-term sales. Musk himself has warned of tough quarters ahead.

Beyond Tesla, Musk’s résumé includes SpaceX and xAI (owner of X). He’s reportedly seeking more control at Tesla — aiming to bump his stake toward 25% — and has hinted he may shift AI efforts to xAI if he doesn’t get more voting power. Those moves underscore a strategy that’s at once corporate, political and personal.

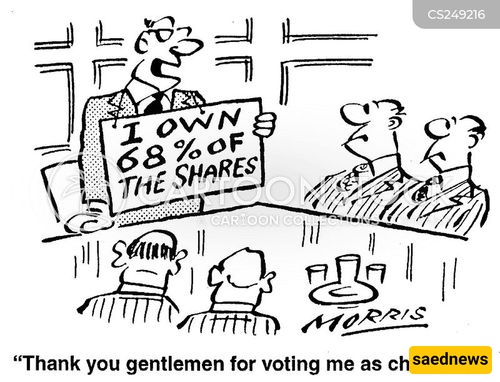

Shareholders will decide on the pay package at Tesla’s annual meeting on Nov. 6, weeks after a Delaware judge tossed out a previous deal as excessive. That vote is now a referendum not only on Musk’s future at Tesla, but on a larger debate over executive pay, the value of innovation and how societies choose to reward winners.