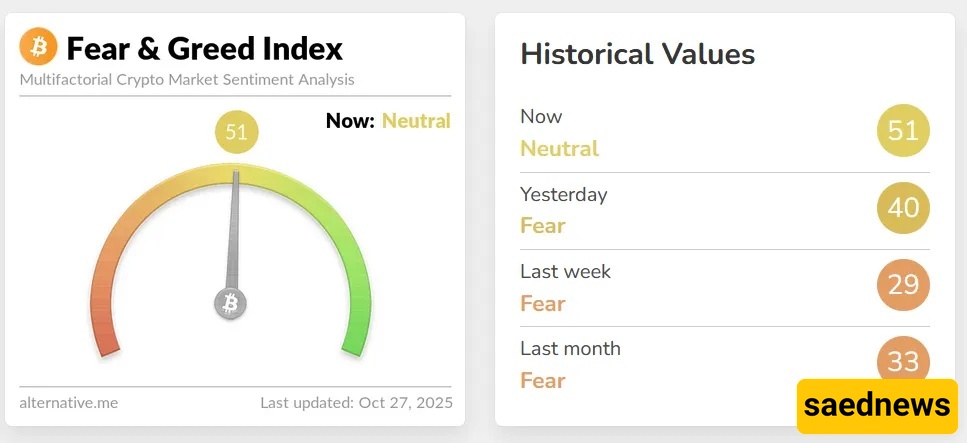

SAEDNEWS: The Fear & Greed Index, which gauges overall market sentiment, has exited the “Fear” zone and reached a “Neutral” level. The index now stands at 51 out of 100, up from 40 on Saturday, marking an increase of more than 20 points over the past week.

According to the Cryptocurrency Service of Saed News, citing Cryptonagar, after former U.S. President Donald Trump announced China’s new tariffs on October 10, the market sentiment index fell from 71 (greed) to the year’s lowest level of 24. At that time, around $19 billion in leveraged positions in the crypto market were liquidated.

Analytical platform Glassnode reports that Bitcoin (BTC) selling pressure has eased in recent days, suggesting a potential trend reversal. Data shows that aggressive selling has subsided, and the funding rate for futures contracts remains below 0.01%, indicating that heavy long positions have yet to form.

Meanwhile, the market is awaiting the U.S. Federal Reserve’s next decision. According to CME Group data, there is a 96.7% probability of a 0.25% interest rate cut at the October 29 meeting.