SAEDNEWS: Money influences many of our decisions, yet our conduct toward it frequently defies rationality. Behavioral economics explains the psychological variables that determine how we save, spend, and invest.

According to SAEDNEWS, money is an essential component of life, yet our judgments about it are not always reasonable. We buy unnecessary items, save less than we should, and shun potentially beneficial investments. Traditional economics implies that individuals behave rationally, constantly striving to enhance their financial well-being. Behavioral economics questions this notion by introducing psychology into the equation. It turns out that emotions, habits, and societal pressures all play a significant part in how we manage money. Understanding these aspects is not only intellectual, but also practical. When we understand why we make particular financial decisions, we may modify our behavior and get better results. In this blog, we'll look at fundamental principles from behavioral economics and how they influence our connection with money.

Mental accounting is the process by which we organize money into separate "accounts" in our thoughts, despite the fact that it is the same currency. For example, we may regard a tax return as "fun money" while being hesitant to spend from our wage savings. Similarly, people frequently treat bonuses or windfalls differently than their normal earnings. This conduct results in inconsistent financial decisions. You may splurge on a fancy item with a gift card but be hesitant to purchase the same item with your funds. To overcome this, regard all money as equal. You can prevent mental traps that lead to overspending or misallocation of funds by assigning them a specific function, such as savings, spending, or investment.

Humans fear losing money more than they enjoy making it. This is referred to as loss aversion, a notion developed by psychologists Daniel Kahneman and Amos Tversky. For example, the agony of losing $50 is more profound than the delight of receiving $50. Loss aversion explains why people frequently avoid taking financial risks, even when the prospective returns are significant. It also encourages behaviors such as hanging onto lost equities for too long, believing they will recover. To overcome loss aversion, concentrate on long-term objectives and see risks as part of a larger picture. Diversification and financial preparation can assist to mitigate the emotional effect of probable losses.

Anchoring happens when people depend too strongly on the first piece of information they come across. For example, if a product is tagged "50% off," you may focus on the initial price rather than deciding if it is worth purchasing at all. Anchoring can influence your perception of investments, housing prices, and even salary while making financial decisions. For example, seeing a high listing price for a property may make other homes appear like bargains, even if they are overpriced. Awareness of anchoring can help you make value-based judgments rather than arbitrary numbers.

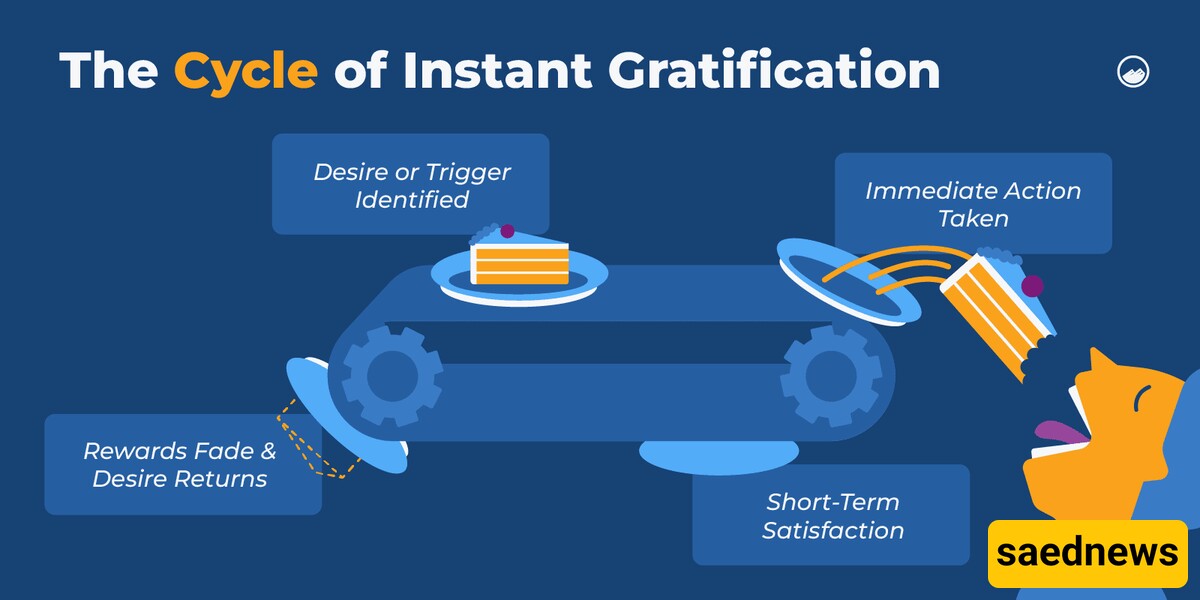

One of the most difficult issues in personal finance is reconciling short-term demands with long-term aspirations. Behavioral economics emphasizes our need for rapid satisfaction, in which we favor present rewards above future gains. For example, while purchasing the latest technology may feel exciting in the moment, it might derail your vacation or retirement savings strategy. To overcome this, you'll need tools like budgeting, automated saves, and visible reminders of your long-term goals. The "marshmallow test" experiment, which examined children's capacity to defer pleasure, demonstrates that discipline is a talent that can be exercised and developed with time.

Other people's activities frequently impact financial decisions. The herd mentality motivates people to follow trends, such as investing in hot stocks or purchasing real estate during a market boom. Social pressure also effects spending, such as going to costly restaurants or buying the latest automobile to "keep up with the Joneses." While social standards might promote healthy competitiveness, they can also result in financial blunders. Recognize when your decisions are influenced by others and focus on what is in line with your financial objectives. It's acceptable to go against the grain if it helps your long-term stability.

Many individuals believe they can forecast financial results. Overconfidence can lead to dangerous investments, excessive trading, and disregarding professional advise. For example, expecting you can outperform the stock market might lead to expensive mistakes. To avoid overconfidence, seek out different opinions, rely on evidence, and consider speaking with financial professionals. A healthy amount of humility might help you avoid rash judgments and remain grounded.

Money and emotions are strongly interwoven. Retail therapy, often known as emotional spending, is a frequent way to cope with stress, unhappiness, and boredom. While it may bring short relief, it might cause financial stress and regret. Developing self-awareness is essential. Monitor your buying habits to uncover triggers for emotional purchases. Instead of impulsively spending, try other strategies to regulate your emotions, such as exercising, meditating, or talking to a friend.

Governments and companies are increasingly leveraging behavioral data to "nudge" people into making better financial decisions. For example, automatic enrollment in retirement programs considerably boosts participation rates. Similarly, apps that round up purchases and store the difference allow customers to easily save money. You may use these nudges in your own life. Automate savings, make bill payment reminders, and define default investment rules. Small modifications can lead to significant benefits over time.

Behavioral economics shows that our financial decisions are impacted by more than just reasoning. Emotions, habits, and social variables all influence how we spend, save, and invest. Understanding ideas like as mental accounting, loss aversion, and rapid pleasure allows us to make better informed decisions. Finally, awareness is the first step toward improved financial wellness. Recognize your prejudices, use techniques that work for you, and stay focused on your long-term objectives. Money is more than simply numbers; it's about conduct. With the appropriate mentality, you can create a financial future that reflects your beliefs and goals.