SAEDNEWS: Bitcoin mining has become a hot topic in the cryptocurrency world, promising potential profits and a hands-on role in the decentralized economy. But is it really worth investing in Bitcoin mining hardware?

Before you hurry to buy pricey mining equipment, we at SAEDNEWS think that you should consider the costs, advantages, and obstacles of Bitcoin mining. In this article, we'll look at what Bitcoin mining comprises, the prerequisites for getting started, and if investing in mining machines is a good financial decision for the typical person or business.

Investing in Bitcoin mining machines may be a successful endeavor, but it comes with major risks and hurdles.

Bitcoin mining is the process of confirming transactions and storing them on the blockchain, the decentralized database that supports Bitcoin. Miners employ powerful computers to answer complicated mathematical problems, which is known as proof-of-work. Why mine Bitcoin?

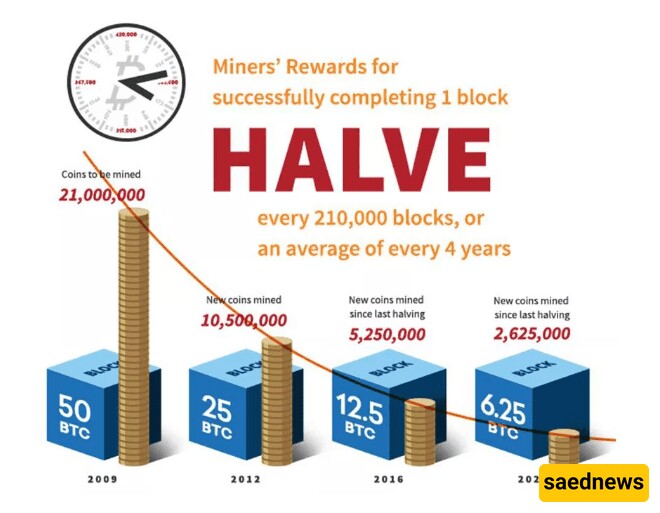

1. Rewards: Miners are paid Bitcoin for solving these puzzles, which is presently 6.25 BTC every block (as of 2024).

2. Transaction Fees: Miners are also compensated for processing transactions.

3. Supporting the Network: Mining protects the blockchain, making it less vulnerable to fraud and assaults.

While the benefits can be profitable, the mining process necessitates tremendous processing power, energy consumption, and an initial investment.

Investing in Bitcoin mining is not as straightforward as purchasing a computer and getting started right away. It need specific tools, resources, and strategy.

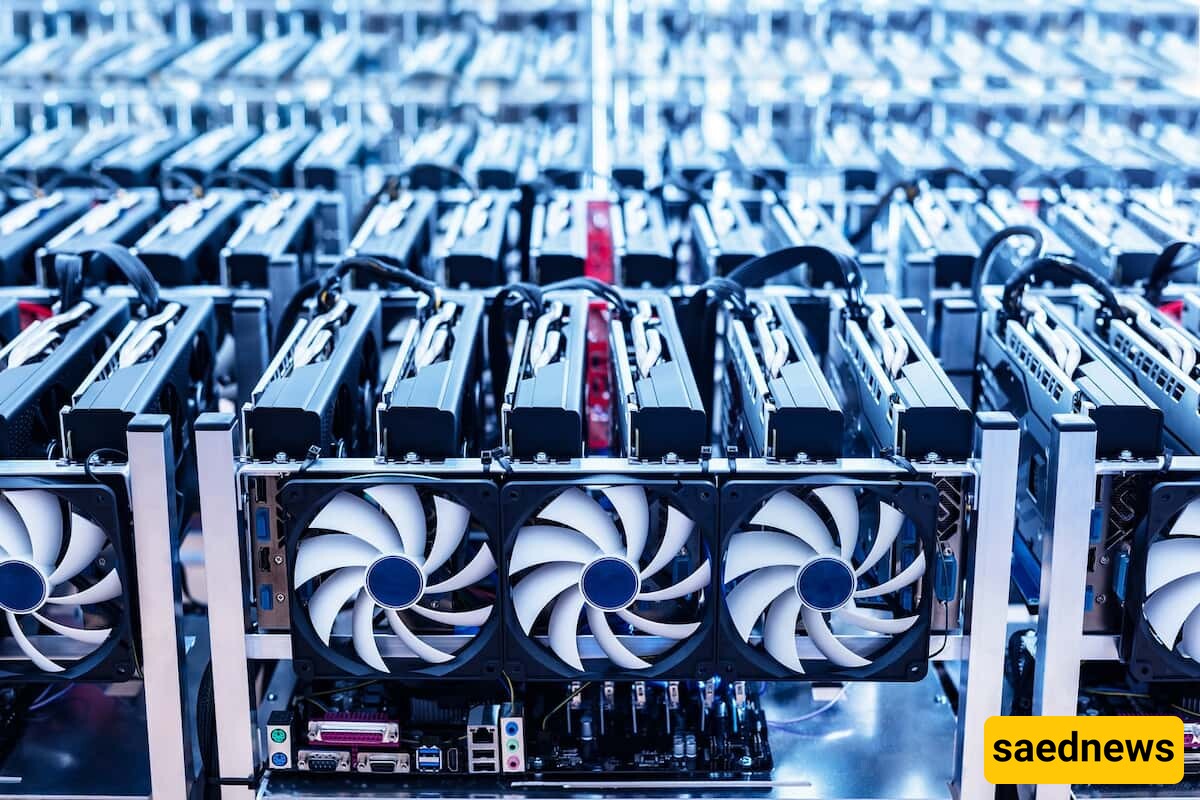

Bitcoin mining necessitates the use of purpose-built application-specific integrated circuit (ASIC) equipment. Popular variants include the Antminer S19 Pro, which is known for its great efficiency and hash rate. Whatsminer M30S: Another solid choice for serious miners. ASIC machines are significantly more powerful than normal computers, but they come at a high cost, ranging from $1,500 to more than $10,000 per.

Energy Supply - Mining requires a lot of power. Access to economical and dependable power is critical for keeping expenses under control.

Cooling Systems - Mining rigs create enormous heat. Proper cooling systems are required to sustain performance and avoid hardware damage.

Mining Software - Software such as CGMiner or BFGMiner links your machine to the Bitcoin network. Choosing the proper software promotes effective operations and revenue tracking.

Mining Pool Membership - Solo mining is becoming increasingly unusual because to the high computing needs. Joining a mining pool allows you to pool resources and share rewards, boosting your chances of earning Bitcoin.

Bitcoin's mining difficulty changes around every two weeks, making it increasingly difficult to solve problems as more miners join the network. This means that you'll need more processing power over time to be competitive.

Bitcoin suffers halving events every four years, which reduce mining earnings by half. The next halving is planned in 2024, with the reward dropping from 6.25 BTC to 3.125 BTC per block.

Bitcoin's price is famously unpredictable. A dramatic drop in value might render mining unprofitable, particularly if operating expenses remain high.

The energy usage of Bitcoin mining has been criticized for its environmental impact. Renewable energy sources can help minimize this problem, although they may not be available to all mines.

Investing in Bitcoin mining computers might be beneficial under the appropriate conditions.

1. Access to Low-Cost Power: Countries with cheap power, such as Iceland or portions of China, offer a considerable cost advantage.

2. Efficient Hardware: Using the newest ASIC models results in improved performance and energy efficiency.

3. Long-Term Perspective: Miners that are ready to wait for Bitcoin values to grow can counteract short-term unprofitability.

4. Scale of Operation: Large-scale mining farms with economies of scale can minimize per-unit expenses while increasing profitability.

Individual miners with limited resources may have lesser profitability, particularly in places with high power prices.

If mining is too expensive or hard, there are other methods to participate in cryptocurrency:

Trading: Buying and selling Bitcoin on exchanges to profit from price swings. Staking: While not relevant to Bitcoin, other cryptocurrencies, such as Ethereum, provide staking incentives for storing coins in a wallet. Cloud Mining: Rent mining gear from a cloud service. However, this strategy has hazards such as frauds and decreased revenue. Freelancing: Accept Bitcoin in exchange for products or services.

Marathon Digital Holdings, for example, operates large-scale mining facilities, maximizing revenues through economies of scale and renewable energy. These companies show that mining may be profitable when done on a big scale with optimal resources.

Many small-scale miners in areas with high electricity prices have abandoned their rigs because to unprofitability. Without access to inexpensive power, mining costs sometimes outweigh revenues.

Mining can deliver consistent profits to those with access to reasonable electricity, efficient technology, and a long-term vision. However, for people in high-cost locations or lacking adequate means, the investment may not be worth it. Before entering into Bitcoin mining, do extensive research, assess prospective income and expenditures, and examine other methods to engage in the cryptocurrency industry. As the industry develops, remaining educated is critical to getting the most out of your investment. Bitcoin mining is an exciting but risky enterprise; whether it is worthwhile depends on your circumstances and risk tolerance.