SAEDNEWS: the globe awoke today to astounding news: Bitcoin has officially reached the enormous milestone of $100,000. This milestone is a watershed moment for both cryptocurrency fans and skeptics, raising serious concerns about the future of digital assets and their role in the global financial system.

According to SAEDNEWS: president elect Donald Trump joined in on the excitement, writing, "Incredible milestone for Bitcoin—huge potential, but let's see what happens. #Crypto" So, what does Bitcoin's $100,000 threshold actually mean? Is it a sign of maturity for cryptocurrencies, a passing fad, or the start of a new financial era? Let's go exploring.

Bitcoin hitting $100,000 is more than simply a figure. It's a psychological and financial threshold that solidifies its position as a serious investor. For years, Bitcoin has been described as the "future of money" while also being derided as a speculative investment.

This milestone validates Bitcoin in the eyes of institutional investors, governments, and the general public. Companies who invested extensively in Bitcoin, such as Tesla and MicroStrategy, are enjoying big profits, which is driving other businesses to include digital currencies in their portfolio.

With more mainstream institutions embracing the crypto revolution, Bitcoin's $100,000 milestone might set off a chain reaction. Banks, payment systems, and retail investors are likely to feel increasingly comfortable incorporating cryptocurrency into daily life.

In a society plagued by inflation, decentralized digital assets such as Bitcoin provide a hedge against traditional currencies. Bitcoin's popularity reflects a rising disenchantment with fiat currency and centralized financial institutions.

President elect Donald Trump's comment regarding Bitcoin's growth caused tremors throughout the financial and political world. Trump, who has previously been critical of cryptocurrencies, acknowledges, if cautiously, that the narrative is moving, even among conservatives. Trump tweeted: "Incredible milestone for Bitcoin—huge potential, but let's see what happens." #Crypto" This endorsement from a worldwide authority strengthens Bitcoin's market position. It also demonstrates how cryptocurrencies has evolved from a small internet forum to mainstream political discourse.

While Bitcoin's expansion is multidimensional, many significant causes have led to its stratospheric rise:

Companies such as PayPal, Visa, and JPMorgan have embraced cryptocurrencies, with many providing services that enable users to purchase, trade, or deal in Bitcoin. Institutional support has established a foundation of legitimacy and trust, accelerating its growth.

Platforms such as Robinhood and Coinbase have made cryptocurrency investment more accessible than ever, allowing average investors to enter the market with as little as $1.

Bitcoin's finite quantity of 21 million coins promotes scarcity, and as demand rises, so does the price.

With growing inflation and economic uncertainty, investors are flocking to Bitcoin as a "digital gold," a store of value that is uncorrelated with established financial institutions.

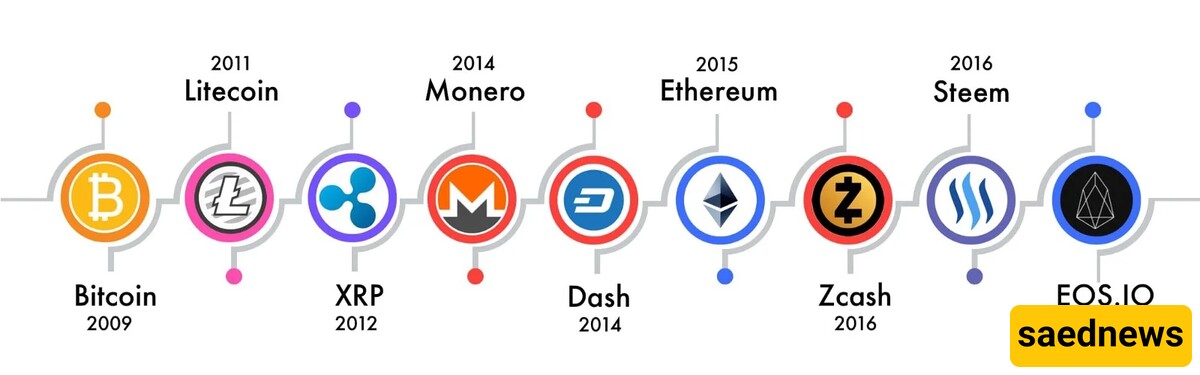

Bitcoin's success is sometimes viewed as a rising tide that lifts all boats. Altcoins such as Ethereum, Solana, and Cardano are expected to gain increasing interest and investment as the crypto industry grows.

Governments throughout the world are likely to step up attempts to regulate cryptocurrencies. While some nations may embrace crypto-friendly laws, others may impose more stringent limitations to safeguard monetary sovereignty.

Bitcoin's success raises awareness of the underlying blockchain technology, encouraging innovation in decentralized finance (DeFi), non-fungible tokens (NFTs), and smart contracts.

While the $100,000 milestone is a remarkable accomplishment, it is not without dangers and obstacles.

Volatility- Skeptics are concerned about bitcoin's price volatility. Sudden market declines may damage trust, especially among rookie investors.

Environmental concerns - Bitcoin mining requires enormous quantities of electricity, prompting concerns for its environmental effect. As Bitcoin increases, so does the push to embrace more environmentally friendly methods.

Regulatory Challenges 0 Governments may establish regulations that impede innovation or make cryptocurrency trading more onerous, influencing Bitcoin's growth trajectory.

Over-Reliance on Speculation - Much of Bitcoin's value is based on speculation rather than utility. To maintain its development, Bitcoin must find broader applications beyond simply a store of money.

Bitcoin's surge above $100,000 has practical ramifications for daily users:

More Payment Options: Businesses are more likely to accept Bitcoin as payment, making it easier to utilize cryptocurrencies in everyday situations.

Increased Investment Opportunities: Financial instruments such as Bitcoin ETFs (Exchange-Traded Funds) provide new ways for people to invest in cryptocurrency without really owning it.

Increased Financial Literacy: As Bitcoin becomes more popular, people are learning more about blockchain, decentralized finance, and digital wallets, resulting in a more knowledgeable financial culture.

Bitcoin’s $100K milestone raises questions over its future direction. Will it continue to rise, or is this a speculative bubble?

An optimistic outlook - Some analysts anticipate that Bitcoin will reach $500K or possibly $1 million in the next years, spurred by institutional adoption, limited supply, and global economic developments.

The Skeptical View - Others worry that Bitcoin's growth is unsustainable, citing its reliance on hype and speculative investments. Critics claim that unless Bitcoin exhibits constant real-world benefit, its value will be erratic.

Bitcoin's rise above $100,000 demonstrates its endurance and rising acceptability, but it also reveals the intricacies of the cryptocurrency market. While it is a big step forward for digital currencies, issues such as volatility, environmental concerns, and governmental constraints persist. Donald Trump's recognition of Bitcoin's milestone highlights its importance in global talks about money and technology. However, the future of Bitcoin—and cryptocurrencies in general—will be determined by their capacity to develop and overcome these problems. Whether you're a seasoned crypto enthusiast or a curious observer, Bitcoin's $100K milestone provides a chance to reflect on the revolutionary potential of digital currencies—and the work that remains to make them a truly sustainable and inclusive element of the financial ecosystem.