SAEDNEWS: The need for safer financial transactions led to bank transfers, a system used since before the 13th century by merchants worldwide. This article explores their evolution and functioning.

According to SAEDNEWS,

Many people move money between accounts through bank transfers. However, if you've never done it before, the process might seem confusing. To make things easier, we’ll explain what a bank transfer is and walk you through the steps so you can confidently manage your finances.

A bank transfer is a financial transaction where a debtor pays a specific amount to a creditor at a predetermined time. This method is considered one of the safest ways to send and receive money, as it eliminates the need for physical cash.

Bank transfers allow you to move funds from your account to another person’s account, and vice versa. Whether you’re paying a bill, sending money to a friend, or receiving a deposit, bank transfers provide a secure and efficient way to handle transactions.

There are four primary ways to complete a bank transfer:

Online Banking Transfers

Mobile Banking App Transfers

Telephone Banking Transfers

In-Branch Transfers

Each bank may offer different transfer options, so it's best to check which methods are available to you.

Among these, the easiest and most commonly used methods are online banking and mobile banking apps. These allow you to enter the necessary details and complete a transfer within seconds. With the increasing shift towards digital banking, online services are now more popular than in-branch transactions.

To send money via bank transfer, you will need:

The transfer date (when you want the funds to be sent)

The recipient's account number

The recipient’s full name

It's crucial to enter the correct details. If any information is incorrect, your transfer may fail or be invalid.

The first time you transfer money to a new recipient, it may take a few hours for processing. However, with faster payment systems in place, most transfers are now completed almost instantly. Transfer times may still vary depending on the banks involved.

In Iran, the two main domestic bank transfer systems are Paya and Satna. Additionally, international money transfer services like PayPal, Western Union, and MoneyGram are widely used for sending funds across borders. Below, we’ll explore the two most common domestic bank transfer systems.

Paya is an electronic banking system that connects all banks in the country. It facilitates electronic payments for loan installments, salaries, pensions, and dividends. Paya receives, processes, and forwards payment instructions.

Paya offers two main services:

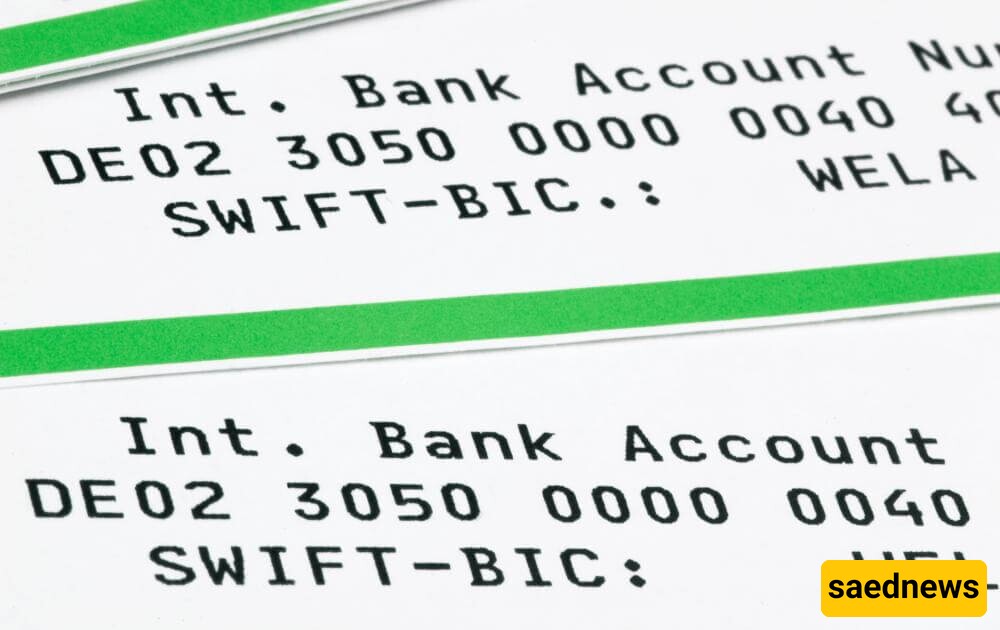

Direct Deposit (VOM) – Using an IBAN (International Bank Account Number), you can transfer funds from one account to multiple accounts. This method is commonly used for salary payments, dividend distributions, and loan repayments.

Direct Debit (BOM) – This feature allows banks to automatically withdraw specific amounts from designated accounts at set times and transfer them to a recipient. Businesses often use this method for recurring transactions.

Paya supports a wide range of financial transactions, including consumer-to-consumer (C2C), business-to-consumer (B2C), and business-to-business (B2B) transfers.

The Real-Time Gross Settlement System (RTGS), known as Satna, was introduced in 2007 and has made financial transactions much more convenient. It enables both online and in-person transfers that are processed instantly.

Key features of Satna:

Transfers are final and cannot be reversed or canceled.

Each transaction is assigned a unique 16-digit payment order number.

All bank account types can use the Satna system.

Transfers take approximately 30 minutes to complete.

A 0.02% fee applies to each transaction.

Satna operates from 8 AM to 4 PM.

The monthly transfer limit per person is 3 billion tomans, while the daily limit varies by bank (in-person transfers are unlimited).

Large transfers require an explanation for the transaction.

Like any financial transaction, bank transfers can sometimes encounter issues. However, most problems can be avoided by carefully reviewing all details before proceeding.

Incorrect Details – If the recipient’s account information is entered incorrectly, the system may not recognize it, causing the transaction to fail. To prevent this, always double-check the details before confirming a transfer.

Transfer Delays – Occasionally, banking system disruptions can slow down transfers.

Despite these occasional issues, bank transfers remain one of the most secure ways to send and receive money.

The first recorded money transfer took place over 150 years ago with the invention of the telegraph. The financial services company Western Union pioneered the first telegram-based money transfer.

In the early days, a sender would deposit money at a telegraph office. The office would then send a telegram to another station instructing them to release the funds to the recipient. This service was widely used for long-distance transactions, and users paid a fee for the convenience.

When banks introduced transfer services, they aimed to streamline the process. With the advent of computers and digital banking, transactions became fully electronic, improving security and reducing costs.

Today, electronic payments are widespread. With just a few taps on a mobile banking app, you can transfer money instantly without visiting a bank branch.

As more people began using electronic bank transfers, the demand for faster transactions grew. In 2008, the Faster Payments Service (FPS) was introduced, allowing near-instant transfers between bank accounts. Today, FPS is one of the most commonly used transfer methods, offering speed and reliability.

Over time, bank transfer systems have evolved to become faster, safer, and more efficient. If you need to send money, simply log into your online banking platform or mobile banking app and follow the steps. With a little practice, you’ll find yourself using bank transfers for all your financial needs!