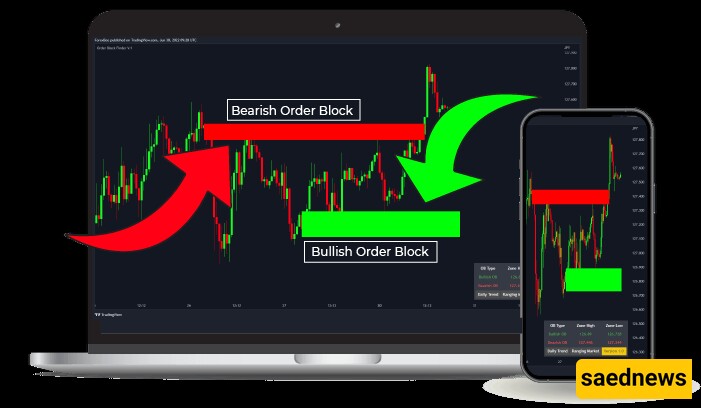

If you have ever been looking to identify important liquidity areas and large orders in the market, you have probably heard of the Order Block indicator. This indicator is actually a tool that traders use to identify important buy and sell zones on the chart.

"But why is this important? Because order blocks are areas where banks, large financial institutions, and major market players place their orders.

In fact, the Order Block indicator in TradingView helps traders automatically identify these zones on the chart and use them to enter or exit trades. This tool is one of the most widely used indicators in technical analysis, as highlighted in an article on Hassan Zadeh Finance’s website:

"The Order Block indicator helps you see price structures the way large financial institutions see them. These zones are where important market decisions are made."

Why should we use the Order Block indicator? One of the biggest challenges traders face is entering at points where the price is likely to reverse or continue upwards. However, many people trade based on emotions and ultimately get caught up in consecutive losses. This is where the Order Block indicator comes in!

Identifying important market areas – With this indicator, you no longer have to guess where the price might reverse. This tool highlights key buy and sell zones.

Improving trading strategy – If you're using price action or classic technical analysis, Order Block can enhance the accuracy of your analysis.

Reducing emotional trading – Because instead of trading based on guesswork, you enter trades based on market data and the decisions of major players.

As Hassan Zadeh Finance's website emphasizes:

Professional traders know how banks and financial institutions steer the market. By recognizing Order Blocks, you can move in the same direction as large investors, not against them.

Therefore, if you're looking for a smarter way to analyze the market, using this indicator can elevate your analysis to a new level.

Can the Order Block indicator increase the accuracy of our trades? Traders are always looking for tools that improve their analysis accuracy and provide more reliable entry and exit points. The Order Block indicator does exactly that, but does this tool really increase our trade accuracy? The answer depends on how it's used.

This indicator identifies areas with high liquidity and a higher likelihood of price reversal. So, if used correctly, it can:

✅ Provide better entry and exit points – Instead of random entries, traders can enter trades based on zones confirmed by big market players.

✅ Prevent entering high-risk trades – Many people enter trades at points where the likelihood of price failure is high. This indicator can reduce such mistakes.

✅ Be combined with other analytical tools – Using Order Block together with tools like support and resistance levels, candlestick patterns, or volume indicators can increase analysis accuracy.

However, this indicator is a helpful tool, not a standalone strategy. As noted on the Hassan Zadeh Finance website:

No indicator guarantees success in the market by itself, but the Order Block indicator can change your perspective on price movements and offer better entry opportunities.

Advantages and limitations of the Order Block indicator in market analysis Every analytical tool has its advantages and limitations, and the Order Block indicator is no exception. Knowing these strengths and weaknesses can help you make better use of it.

✅ Advantages of the Order Block indicator

✔ Automatic detection of Order Block areas – No need for manual drawing; key buy and sell zones are marked.

✔ Increased technical analysis accuracy – As a supplementary filter, it can prevent entering low-quality trades.

✔ Usable across all timeframes – Whether in scalping or long-term trades, this indicator is effective.

✔ Increased success probability – Helps traders move in the same direction as large market investors.

⚠ Limitations of the Order Block indicator

❌ Needs confirmation from other tools – It’s not sufficient on its own and should be used alongside other analyses.

❌ Possible false signals in volatile markets – In conditions with high volatility, it might highlight incorrect zones.

❌ Does not explain the reason behind the formation of Order Blocks – The indicator just identifies the areas but doesn't explain why they formed.

As stated on Hassan Zadeh Finance’s website:

This tool is useful for increasing analysis accuracy, but no indicator replaces the trader's knowledge and skill. Using the Order Block alongside proper risk management and comprehensive analysis can yield the best results.

So, if you plan to use the Order Block indicator in your trades, be sure to consider its weaknesses and strengths for more accurate analysis and smarter decisions.

Summary

Is this indicator right for you?

If you’re looking for a tool that can identify key areas of large orders and align you with institutional investors, the Order Block indicator could be a useful option. However, the important point is that no indicator performs miracles, and this tool is no exception.

🔹 This indicator is suitable for you if:

✅ You want more precise entry and exit points and are looking for strong liquidity zones in the market.

✅ You know technical analysis and can use the Order Block alongside other tools like support and resistance, price action, or volume.

✅ You're looking for a complementary tool, not an independent trading system.

🔸 But if:

❌ You’re just looking for a magical button to make profits without a proper understanding of how the market works,

❌ You don’t value multidimensional analysis (combining fundamental, technical, and sentiment),

❌ You lack the ability to control risk and manage capital,

📌 This indicator won’t work miracles for you and could even lead to losses.

Ultimately, the Order Block is a tool that can enhance trade accuracy, but your success depends on how you use it and how you combine it with your knowledge and experience. If used wisely, you can increase your competitive advantage in the market and make more informed decisions. 🚀"