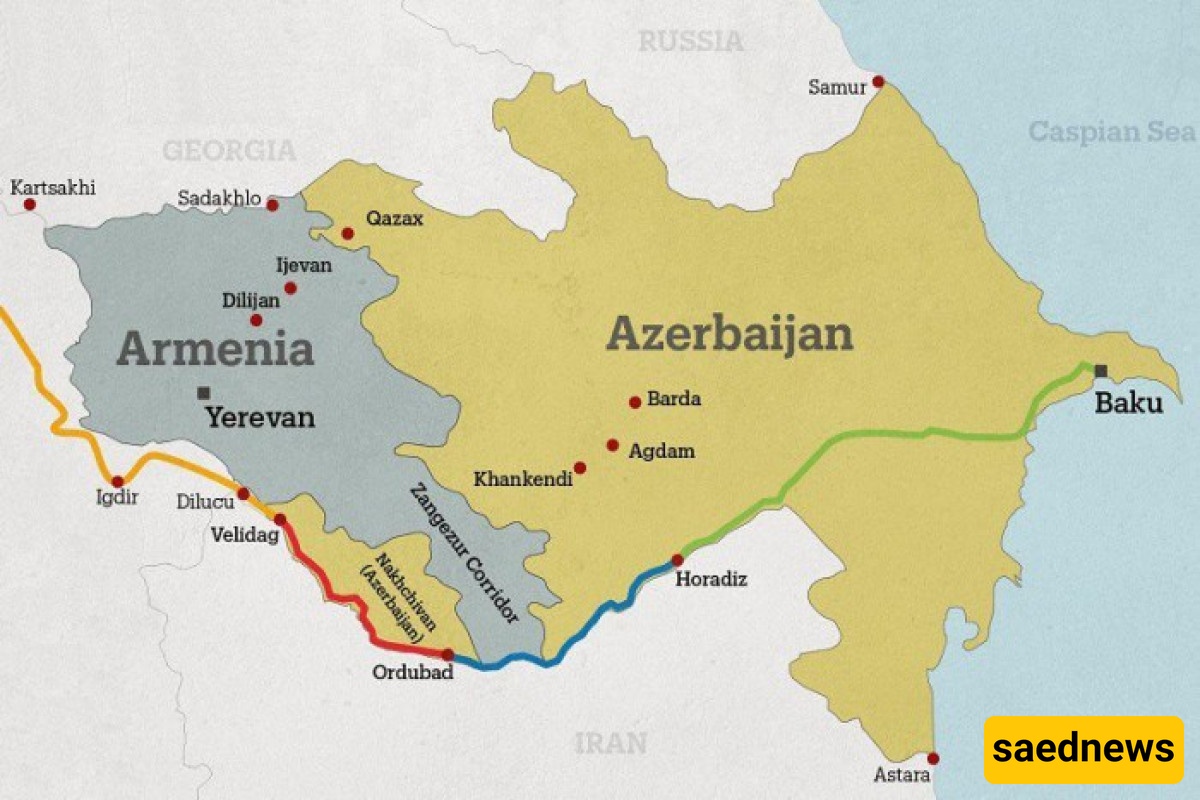

SAEDNEWS: In the heart of the South Caucasus, a narrow strip of Armenian land has become a new stage for great power competition; the plan to lease the Zangezur route for 100 years could transform Eurasian trade, Europe’s energy market, and the balance of power in the South Caucasus—or become a symbol of diplomatic failure in the multipolar world.

According to the economic service of Saed News, the Zangezur Corridor will generate between $50 billion and $100 billion in annual trade value for its partners by 2027.

The 43-kilometer Zangezur route in southern Armenia might seem at first glance to be just a geographic passageway, but given today's geopolitical context, it has become one of the most sensitive points of great power competition. The U.S. plan to lease this route for 100 years could not only reshape Eurasian trade and energy routes but also alter the balance of power in the South Caucasus and even the European energy market.

The events of September 2023, when Azerbaijan took full control of Nagorno-Karabakh without Russian intervention, dealt a severe blow to Moscow's credibility. Moscow, which for years had positioned itself as the security guarantor of the South Caucasus, lost Armenia’s longstanding trust due to its lack of response, prompting Armenia to unprecedentedly pivot its foreign policy westward.

This shift was formalized by the signing of a strategic charter with the U.S. and the ratification of Armenia’s accession to the European Union in April 2025. This situation has created a rare window of opportunity for U.S. influence in a region that was previously Russia’s backyard.

Under these circumstances, the Zangezur project holds significant economic appeal. World Bank estimates suggest this route could generate $50 billion to $100 billion in trade annually and reduce transit time between Europe and Asia by up to two weeks.

The logistical savings from this route are forecasted to reach $20 billion to $30 billion per year, with Azerbaijan alone potentially increasing its exports by over $700 million.

From an energy perspective, this corridor’s role could be pivotal. According to the International Energy Agency, the European Union will need an additional 20 billion cubic meters of non-Russian gas by 2030, and this route could provide direct access to Caspian gas resources, cutting import costs by up to 15%.

For Europe, this corridor means access to Caspian energy and reduced dependence on Russian gas. The EU is expected to require 20 billion cubic meters more non-Russian gas by 2030, and Zangezurcould help fill that gap.

However, economic appeal is only part of the story. The main obstacle is the deep political divide between Yerevan and Baku. Azerbaijan, the victor of the 2023 war, demands unrestricted access to this route, while Armenia refuses to cede control even symbolically.

The American magazine Forbes writes that the U.S. proposal to ‘lease’ the route is an attempt to ensure international management and security while maintaining Armenia’s official sovereignty; this model, reminiscent of the Panama Canal or the Berlin Corridor, could unlock the dispute but risks stirring nationalist sensitivities and accusations of neo-colonialism.

Iran:

Simultaneously, regional and extraregional actors view the project differently. Iran faces direct economic threat as it loses a significant part of its transit role and thousands of Turkish trucks that annually cross its territory.

Russia:

Russia risks losing potential revenues of $10 to $20 billion and part of its leverage over the European energy market.

China:

China welcomes the route for its logistical savings in the Belt and Road Initiative but must also reconcile with Europe’s decreasing reliance on China-controlled routes.

Turkey:

Among all players, Turkey stands to benefit the most directly, as the corridor could reinforce Ankara’s position as an energy and transit hub, generating billions of dollars in annual revenue. Businesses in Eastern Anatolia predict exports could rise from $160 million to $500 million if the project materializes.

Yet, the project’s risks are serious. Reports suggest a 60% chance of stalled negotiations and a 12 to 18-month delay in implementation. Lloyd’s data from June 2025 warns of a 20% fluctuation in goods and a 20% increase in premiums if talks fail.

Even with UN oversight, success rates are estimated below 50%, as Armenia’s veto due to sovereignty concerns remains likely.

Costs may rise by up to 20% due to political deadlock, and any domestic or regional unrest could jeopardize investments.

Despite these challenges, the Zangezur project represents a rare chance for Europe to genuinely diversify energy sources and reduce dependence on Russia and Iran.

For the U.S., this corridor is not merely a trade route but a test of creative diplomacy and the ability to broker complex agreements in conflict zones.

If the project succeeds by 2027, it could activate multi-billion-dollar trade flows and an 11 million-ton cargo capacity, while strengthening Washington’s geopolitical stance against Moscow, Beijing, and Tehran. Conversely, failure would symbolize the limits of U.S. influence in today’s multipolar world.

The future of the Zangezur route lies between two opposing scenarios. Success by 2027 could see the corridor facilitating $20 billion to $50 billion in annual trade, activating an 11 million-ton cargo capacity, and turning Turkey into a key regional energy and transit hub—transforming the South Caucasus economy and reducing Europe’s reliance on costly routes.

In the failure scenario, ongoing political deadlock and sovereignty sensitivities could erode trust in U.S. mediation, forcing Europe to continue using lengthy, risky routes—resulting in a lost rare strategic opportunity."