The Difference Between Riba And Nuzool Should Be Sought In Their Function And Even Their Ruling. Remember, Not Every Nuzool Has The Ruling Of Riba And Is Forbidden; They Have Different Types And Must Be Examined.

What is Nuzool?

Nuzool of money or goods, in terminology, means reduction or discounting, and in practice, it refers to decreasing the amount of money or the monetary value of goods. This reduction is not always considered forbidden or classified as riba.

Types of Nuzool

Discounting Debt with the Debtor Himself

If someone sells a product and takes a check or promissory note from the buyer dated a few months later, and before the due date needs cash, they can approach the same buyer and exchange their check for a cash amount less than the check’s face value. For example, if someone sold goods worth 10 million tomans by a 4-month check and now needs cash, they can return the 10-million-toman check to the buyer and receive a smaller amount in cash (e.g., 9 million tomans). This type of discounting, called "discounting the debt with the debtor himself," is considered permissible and halal by all Shia and Sunni jurists.

Discounting Debt with a Third Party

If in the previous example, the buyer refuses to give cash less than the check amount, and the seller must approach a third party to get liquidity by selling the check or promissory note for less money, this case is different. In other words, the check owner sells it to someone else who was not part of the original transaction and receives less money for liquidity. This type, called "discounting debt with a third party," is a matter of dispute among jurists. The majority of jurists, religious authorities, and the Guardian Council consider this type of transaction permissible, but some authorities like Imam Khomeini and Ayatollah Khamenei consider it problematic and invalid.

Discounting with Fictitious Documents

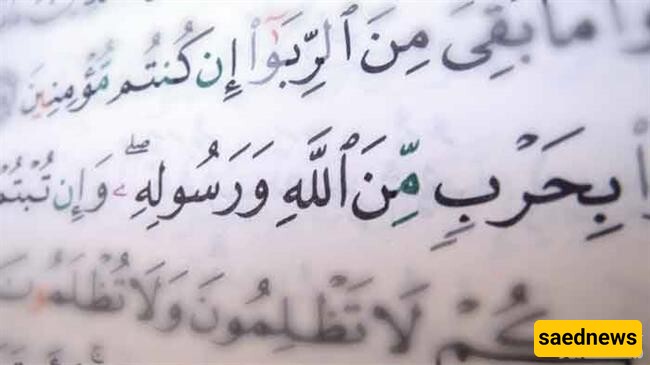

The third type, called "discounting with fictitious documents," occurs when someone issues a check or promissory note for several months without any real transaction or exchange of goods and sells the check to someone else, effectively discounting it. All jurists consider this type forbidden and equate it with riba. This is the common form known in society as nuzool and riba and carries the ruling of riba. The difference between riba and nuzool lies in the first two types, which have different rulings.

Differences and Similarities Between Nuzool and Riba

The discussion of nuzool and riba in the market shows differences but also some similarities. In Islamic jurisprudence, there is a contract called the sale of debt, meaning sometimes a person sells property or goods on credit.

For example, a person sells a car on a six-month term and receives a 10-million toman check or promissory note for six months. During these six months, the seller might need liquidity and agree to transfer the check or promissory note at a lower price to another person.

Usually, the seller first approaches the debtor (buyer) and offers to transfer the 10 million toman debt at 9 million tomans. If the debtor agrees, this is called "selling the debt to the debtor himself" or "discounting the debt with the debtor," accepted by all Shia and Sunni jurists and Islamic scholars as permissible.

The second type occurs when the debtor cannot pay the debt earlier and says they can only pay on the due date. Here, the creditor (seller) must transfer the check or promissory note to a third party. This is called "discounting the debt with a third party" or "selling the debt to a third party."

This type is disputed in Islamic law. Most Shia jurists historically and the Guardian Council of the Islamic Republic of Iran do not object to it and believe it is not riba, but some other jurists such as Imam Khomeini and the Supreme Leader consider it problematic.

What Is Halal Profit?

Halal profit is any gain obtained without involving the characteristics of riba and while observing the conditions of buying, selling, and so on (as explained in the jurists' manuals), it is permissible.

For example, if in a loan, no excess amount is stipulated but the debtor voluntarily pays more when repaying, it is not forbidden and is even recommended in religious texts.

Also, cases such as riba between father and son, husband and wife, or a Muslim taking riba from a non-Muslim dhimmi are not forbidden, and details are available in jurisprudential books.

However, if by halal profit you mean the interest banks of the Islamic Republic of Iran pay to depositors, it should be noted that these banks act as agents for depositors, using their deposits under Sharia contracts (such as mudarabah, partnership, etc.) to provide loans to borrowers who are the contractors and executors, and the profit paid is considered provisional and eventually final. This is mostly accepted by jurists and maraji' and considered permissible for depositors.

Regarding the prizes that banks give through draws to some account holders of Qard al-Hasanah accounts, this is different from bank profit. All jurists agree that if the depositor or customer does not deposit money with the intention of winning prizes or on the condition of the draw, then using and possessing the prize is permissible. However, it is necessary to consult your religious authority for specific rulings.

Jurists who do not allow possession of the prize restrict the prohibition to cases where the depositor deposits money with the intention or condition of winning the prize.

Some jurists also require the permission of the religious ruler for the permissibility of using the prize if the bank is not private but governmental or shared.