Since the solar year is different from the lunar year, it is better to base the calculation on the lunar year, which is slightly shorter than the solar year, although the esteemed religious authorities consider calculations with both to be permissible.

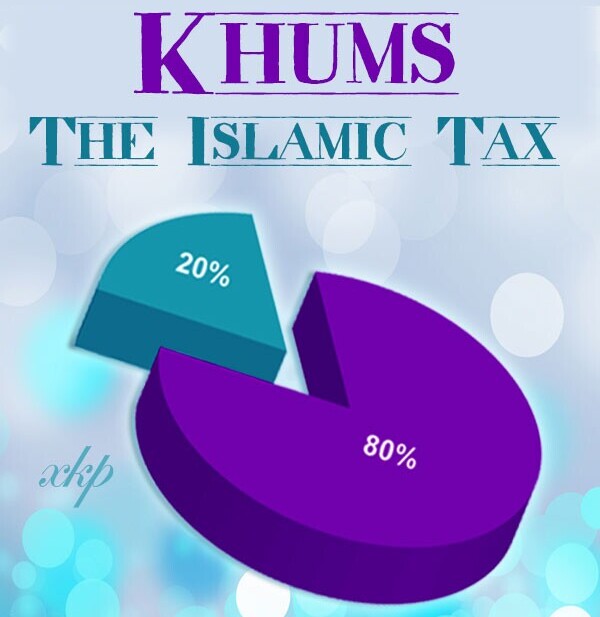

The Khums year is the one-year period during which the calculation of Khums begins after receiving the first income. Khums is one of the branches of the sacred religion of Islam, and it is a rule mentioned not only in Hadith but also explicitly in the Holy Quran, specifically in Surah Al-Anfal, verse 41:

"And know that anything you obtain of war booty—then indeed, for Allah is one fifth of it and for the Messenger and for [his] near relatives and the orphans and the needy and the [stranded] traveler, if you have believed in Allah and in that which We sent down to Our Servant on the Day of Criterion—the Day when the two armies met. And Allah is over all things competent."

Inherited wealth.

Gifts given to a person.

Prizes received.

Holiday gifts (Eidi).

Money received as Khums, Zakat, or charity.

A woman's dowry.

The calculation of the Khums year starts from the time the first income is received—income that is subject to Khums, not like inheritance, dowries, or blood money, but like wages, business profits, etc. This time becomes the starting point of the Khums year, and throughout the year, any amount spent on necessary living expenses will not be subject to Khums. However, whatever remains until the end of the year, which returns to the same starting point, is subject to Khums (one-fifth for Imam Mahdi, peace be upon him).

To make an action obligatory, it is not always necessary for it to be explicitly stated in the Quran, as many details of religious acts are not mentioned in the Quran but are learned through the traditions of the Prophet (peace be upon him) passed down through his family and their narrations. For example, the number of daily prayers, their Rak'ahs, the way of bowing and prostrating, Hajj rituals, and so on, while no one doubts that these details and rulings are part of Islam.

For instance, if the first income received is on the 10th of Ramadan, then the Khums year starts on the 10th of Ramadan, and until the 10th of Ramadan the following year, any income spent on regular living expenses—expenses that are appropriate to one's social status—will not be subject to Khums. When the 10th of Ramadan next year comes, whatever remains of the income from the year will be subject to Khums, whether it is in the form of cash or goods consumed gradually, such as rice, legumes, etc. However, items like carpets, if their purchase is necessary according to common sense, will not be subject to Khums.

A person without a job, if they happen to do a transaction and make a profit, after one year has passed since the profit, they must pay Khums on any excess amount that has not been spent in that year.

There is a difference of opinion among religious scholars regarding certain types of income (e.g., gifts, bank bonuses, etc.).

The woman's dowry and inherited wealth are exempt from Khums.

If a person has overspent their annual budget, they must pay Khums on the excess.

If there is doubt about whether a host pays Khums, investigating is prohibited, and eating their food is permissible.

Scholars have outlined several consequences of not paying Khums:

A person cannot use their wealth until they pay Khums. For example, food that has not had Khums paid on it cannot be consumed.

If a person buys or sells with money on which Khums has not been paid (without the permission of the religious ruler), the transaction is invalid for the amount of Khums. Similarly, if they gift it to someone, the recipient cannot use the amount equivalent to the Khums.

If a person tries to pay Khums money to the owner of a bathhouse and performs a ritual bath (Ghusl), their Ghusl is invalid.