SAEDNEWS: Huawei has not yet established itself as the top smartphone brand, but it is the world’s largest telecommunications equipment manufacturer.

According to Saed News’ Success Service, Huawei has not yet claimed the title of the world’s best smartphone brand—but it remains the largest telecommunications equipment manufacturer in the world.

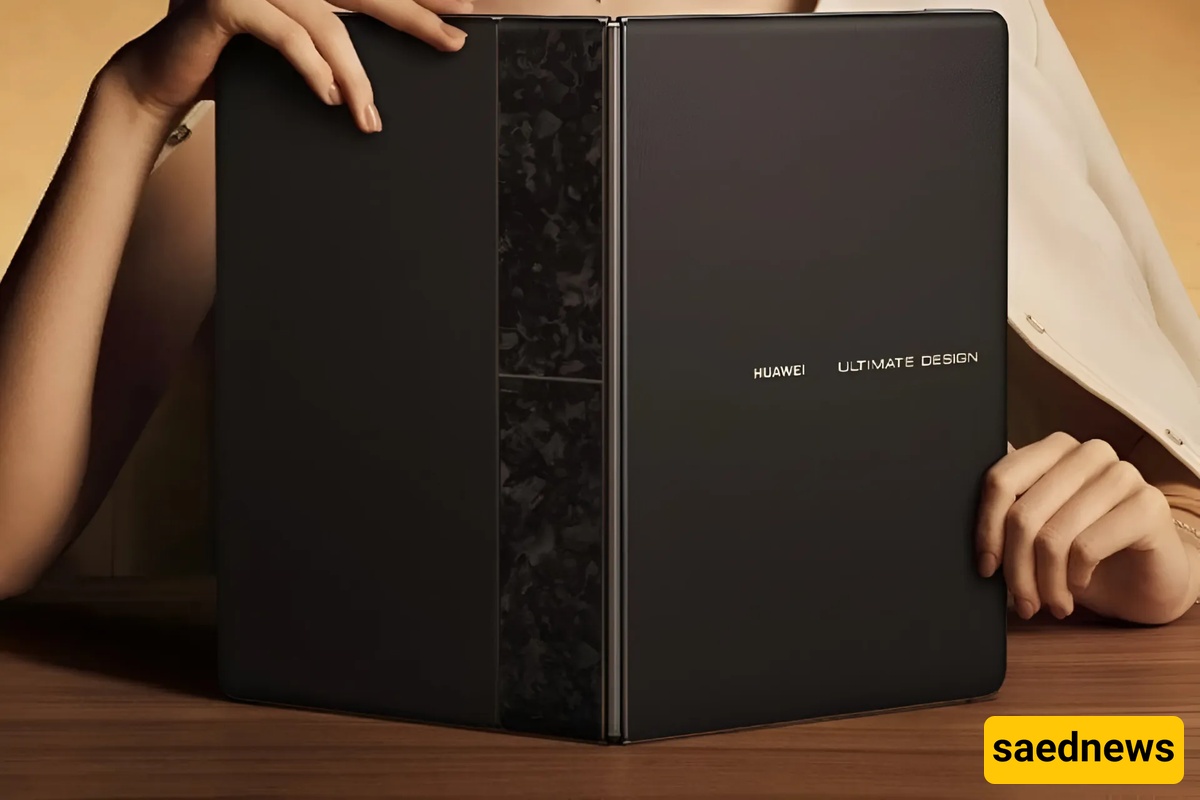

On August 29, 2023, Huawei unveiled its new smartphone, the Mate 60 Pro. Many had assumed that under heavy U.S. sanctions, the company would never regain its former stature. The centerpiece of this launch wasn’t the device’s appearance, but the chip inside:

The Kirin 9000S processor, 5G-enabled, made in China by SMIC using 7-nanometer technology—a chip that, according to many experts, shouldn’t exist under current sanctions.

This event was more than a product launch; it symbolized China’s technological resurgence and posed a direct challenge to restrictive U.S. policies. For a company that began in a small Shenzhen office, scaled global heights, faced repeated setbacks, and continually reinvented itself, the Mate 60 Pro represented a spark of renewed confidence.

Huawei began by selling telephone switches in rural China. Its “from the margins to the center” strategy transformed it into a global giant in telecommunications and smartphones. Yet, U.S. sanctions in 2019—blocking access to critical technologies like Google’s Android and advanced chips—pushed the company to the brink of collapse.

In response, Huawei focused on the domestic market, invested heavily in research and development, and developed homegrown technologies like the HarmonyOS operating system and the Kirin 9000S chip. These efforts not only ensured survival but enabled a powerful comeback. Today, Huawei is expanding into AI, smart vehicles, and other fields, aiming to build a self-sufficient technology empire while competing globally despite international challenges.

By 2024, Huawei’s performance resembled a business miracle: revenue of 862.1 billion yuan ($118 billion), a 22% increase from the previous year, and a strong return to regional competition. Huawei is now a leader not only in telecom equipment but also in smartphones, 5G, AI, and smart vehicles. Its story is one of perseverance and reinvention amid one of the most intense geopolitical conflicts of our time.

Huawei’s story begins with engineer Ren Zhengfei, born in 1944 in the impoverished Guizhou province. Despite having a father who was a school principal and a mother who was a teacher, his family faced financial hardship. Trained in architecture and civil engineering, Ren’s life took him in unexpected directions.

In 1974, he joined the Engineering Corps of the People’s Liberation Army. Nearly a decade of military service instilled discipline, patience, and strategic vision—qualities that would later form Huawei’s corporate culture.

After retiring in 1983, Ren moved to Shenzhen, a city emerging as the symbol of China’s economic reforms. After several failed ventures, he founded Huawei in 1987 with 21,000 yuan (roughly $3,000). The name combined hua (China) and youwei (achievement/promising), symbolizing “China’s flourishing.” Ren did not want a conventional company; he envisioned a technological army capable of triumphing in the toughest battles.

Huawei started as a small trading company importing telephone switches from Hong Kong to sell in China’s small towns and rural areas. The company also engaged in reverse engineering foreign technology—a practice seemingly simple but underpinned by strategic thinking.

Ren understood early on that Huawei couldn’t compete head-on with foreign giants in lucrative urban markets. Instead, he focused on overlooked areas with less competition and more urgent needs, a strategy later called “from the margins to the center.” This approach allowed Huawei to grow profitably while deepening its understanding of China’s unique market demands.

The first major success came in 1993 with the C&C08 digital switching system, designed to improve communications in provinces and small cities. Beyond its technical prowess, the C&C08 symbolized Huawei’s technological independence.

After dominating rural markets, Huawei gradually entered urban China in the late 1990s. Strategic partnerships, including one with consultancy McKinsey, modernized management systems and professionalized operations. By 2000, Huawei controlled over 40% of China’s telecom equipment market.

International expansion began cautiously, targeting countries with urgent telecom needs but limited budgets, such as Russia, Brazil, Thailand, and Kenya. Huawei offered affordable, reliable equipment along with local training and support, building a new generation of skilled engineers and a reputation for complete solutions rather than just products. By 2009, Huawei was active in over 100 countries, with international sales accounting for 65% of revenue.

Huawei entered the smartphone market in 2009, dominated by Apple, Samsung, and Google. Early devices like the Ascend series targeted affordable markets, particularly in Africa, Southeast Asia, and Latin America. The company gradually moved upmarket with the P series (focusing on design and cameras) and Mate series (high-performance devices with large screens and batteries).

Partnership with Leica in 2016 elevated Huawei’s global image, signaling that it was no longer a budget brand but a serious competitor to Apple and Samsung. By 2018, Huawei had become the second-largest smartphone manufacturer globally, surpassing Apple temporarily and setting new standards for design and photography.

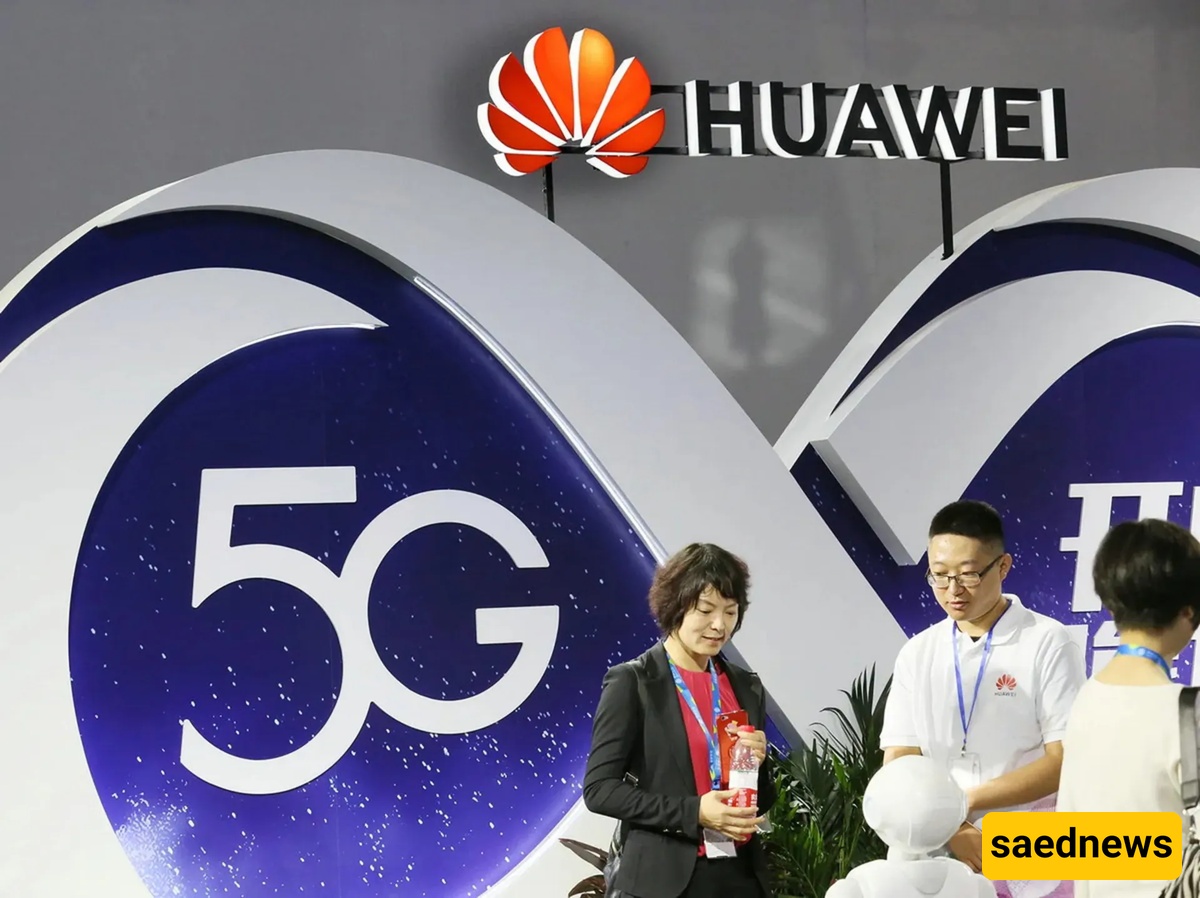

Huawei invested heavily in 5G R&D starting in 2009, eventually amassing over 3,500 essential patents. By 2018, analysts noted Huawei was 12–18 months ahead of competitors. Unlike rivals, Huawei could design end-to-end 5G networks—from base stations to core infrastructure and management software—giving it a unique advantage.

By 2019, Huawei had signed 5G equipment contracts with over 40 global operators and played a key role in defining international 5G standards. Its dominance wasn’t just technological but geopolitical, drawing scrutiny from Washington and allies concerned about Chinese control over critical infrastructure.

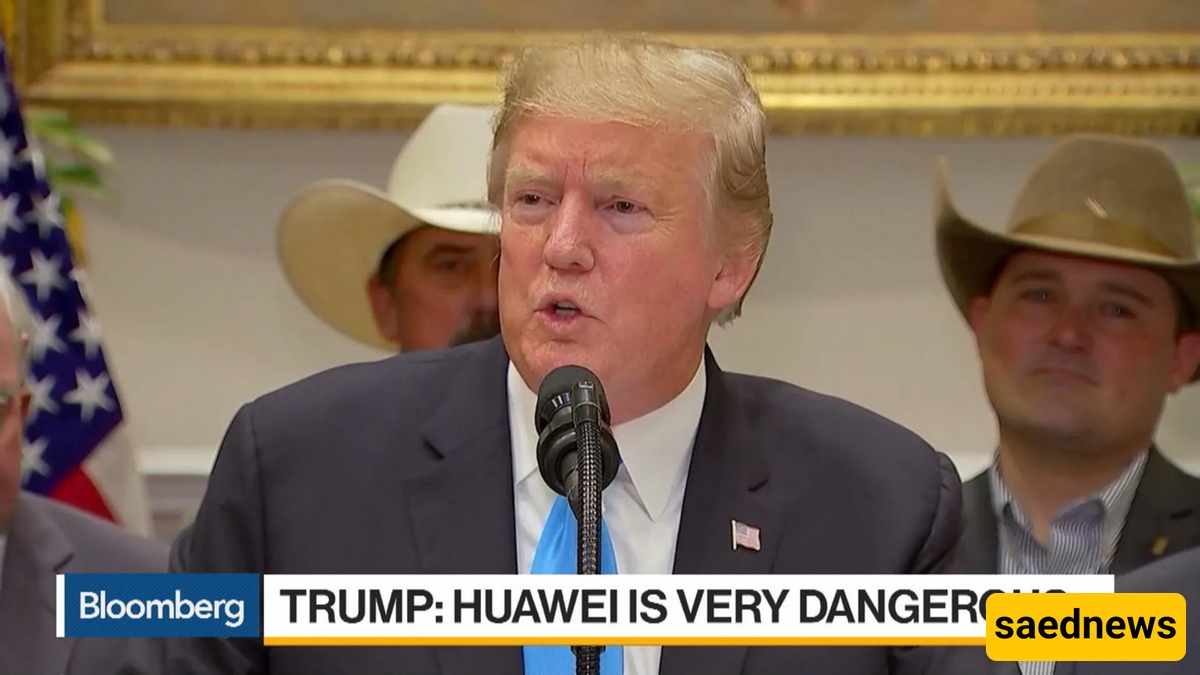

In May 2019, the U.S. added Huawei to its “Entity List,” banning American companies from collaborating with Huawei. Google revoked Android licenses, cutting off access to popular apps, while hardware restrictions prevented Huawei from sourcing advanced chips. The company’s smartphone sales plummeted by 85% internationally, forcing the sale of its Honor brand in 2020 to preserve its survival.

Huawei shifted focus to domestic markets and homegrown technologies. R&D spending exceeded 20% of revenue, leading to innovations like HarmonyOS—an Android-independent operating system that by late 2024 ran on over a billion devices, from phones and tablets to TVs and cars, capturing 19% of China’s OS market.

In August 2023, Huawei quietly launched the Mate 60 Pro, powered by the domestically produced Kirin 9000S chip. Features like satellite calling and 100x zoom highlighted the company’s technological comeback. 2024 revenue reached 862.1 billion yuan ($118.2 billion), with consumer business revenue growing 38.3%, and market share in China rising from 12% to 16%.

Huawei also innovated with devices like the Mate XT, the world’s first commercial triple-fold smartphone, and HarmonyOS-powered computers, signaling ambitions to challenge Windows and macOS. Smart vehicle initiatives, including autonomous driving and connected ecosystems, further diversified the company’s portfolio.

Despite impressive achievements, Huawei still faces challenges: limited access to advanced 3nm chips, GPU constraints affecting AI development, and the absence of Google services limiting international appeal. Some countries plan to phase out Chinese 5G equipment, restricting Huawei’s export markets. Balancing short-term profitability with long-term investment will determine whether Huawei can reclaim its global dominance in technology.